Ideas Stock Markets- why investors, authors and readers behave similarly?

Is trading ideas in meetings similar to trading stocks in stock markets?

Can the stock markets be the metaphor for “trading ideas” in-group meetings such as those in businesses and even at family gathering, or discussions on social platforms? Instead of selling and buying stocks, it is selling and buying ideas.

The above two questions clouded my mind over the last few days and surprises emerged in trying to search for answers to resolve them.

To start with- how these questions popped up in my mind?

I consider myself fortunate that most of my posts attract many comments. Analyzing those comments revealed several observations and questions as well. The authors as well as the readers may experience few of these observations and maybe asking the same questions. These include among others:

· Writer of the comment agrees. Is it of Confirmation Bias to what she/he knows? This bias creates another bias that is the Blind-Spot Bias because of falling to the spot of owned confirmation bias.

· I agree with most comment here- is it because of the paradox of Conformity Bias?

· Recent findings suggest- is it because of the Recency Bias in which new information is overly weighted?

· The first comment by an acclaimed writer- is it the Anchoring Bias that is operating because over-reliance on the first comment, notably if it is from an established resource?

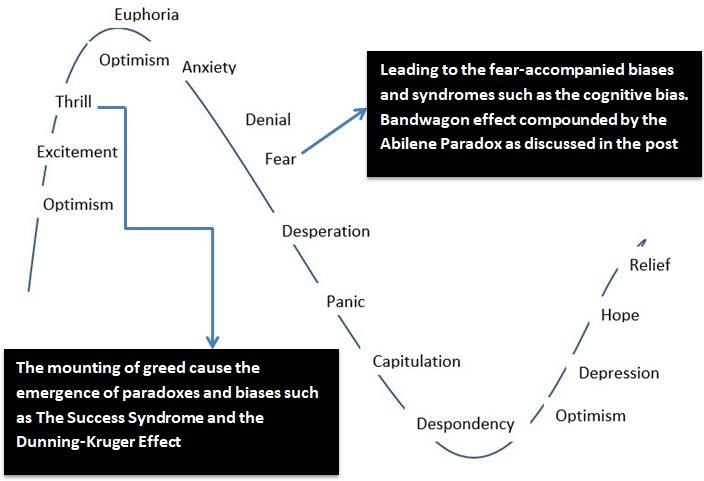

· The majority of comments are in agreement with the author- is it because the Bandwagon Effect attractor where the majority likes to settle in? This can be compounded by the Abilene Paradox in which the individuals maybe right, but fake assumptions of others’ suggestions are right even when they are wrong lead the comments’ writer to make the wrong evaluation of a post?

· The comments align with your long-owned beliefs- is this the Conservation Bias that satisfies the writer’s and readers’ egos?

· The majority of comments agree with the writer- and so the new comments tend to follow pattern. Is this because of the Zero-Risk Bias in operation as there is less risk in following the majority cascading to Separation-Risk Bias?

· The last few posts by the author had a streak of positive comments- and so the new post is a good one resulting in the Power-Streak Bias?

· Most comments are in agreement with the author even though they negate the readers’ evaluation. This may trigger the Imposter Paradox and the reader writes a comment that is in agreement with the majority because of self-doubt?

· the sentiments are mostly in agreement (or disagreement) with the author- even though the reader has a different thought than the writer of the post she/he writes an agreeable comment in alignment with the majority- this leads to a mind-heart gap and the Gap Paradox emerges. This issue I explained in my book in Arabic “Taming the Future”. It is when my mind urges me to sign a peace treaty with an enemy, but my heart says no. The fear to write a comment negating the majority even though my mind says they are wrong is applicable to the Comments Paradox.

· The writer of the post exposes the readers to many new topics the readers are unfamiliar with. They feel they know less than before reading the post. This creates what I describe as the Knowledge Inferiority Paradox and so I wrote an agreeing comment even though inside me I do not.

· a reader writes a comment criticizing the expert author because the reader is seeking fame- the Play-Big Greed for fame is distorting the reality.

· The greed makes successful traders drunk by their success- the “Success Syndrome” starts to be progressively more dominant as the greed for more blinds those investors to their forthcoming disappointments and nasty surprises. Authors are subject to exposure by the same paradox.

· The success syndrome is then coupled with the emerging syndrome- more successes invites the Dunning-Kruger effect to take the lead. The less smart investors believe that they are smarter and more capable than they really are. Their success falls apart. Likewise, the less smart readers may jump on the wagon as acclaimed experts.

There are always over-valued and under-valued stocks. Likewise, there shall be always over-valued and under-valued authors, readers, posts and comments. These shall continue as long there are biases and paradoxes.

Analogy with the Stock Markets

Reviewing the previous paradoxes and biases will point out that fear is a common denominator among them. Fear of risk, fear of labeling, fear of not conforming, fear of being accused as ignorant, fear of deviation and fear of isolation and other fears dictate on the reader what to say in her/his comment and the authors what to write. The other factor, which is greed, leads to the distortion of the value of comments and may spoil the authors as well.

Fear and greed are the two major factors that may lead to the misleading posts and/or comments. These two factors operate in meetings and in the stock markets. In meeting and including virtual meetings, these two factors operate as well. The social platform is the meeting room for readers to exchange the stocks of ideas.

The question that follows is if the wave’s say of comments would follow the pattern of the waves that we observe in the stock markets. Let us examine the feelings that dominate the stock markets to visualize the correlation first.

Meeting with self is unlike meeting in groups. The group influences the thinking and emotions of the individual and the individual in turn affects the thinking and emotions of the group. These interactions lead to the emergence of the paradoxes and biases discussed earlier. Investors meet in the exchange hall of the stock markets and they meet in a room or virtually on a social platform.

The Paradoxes of the Stock Markets is analogous to the Ideas Stock Markets. In both markets, people trade either stocks or “ideas stocks”.

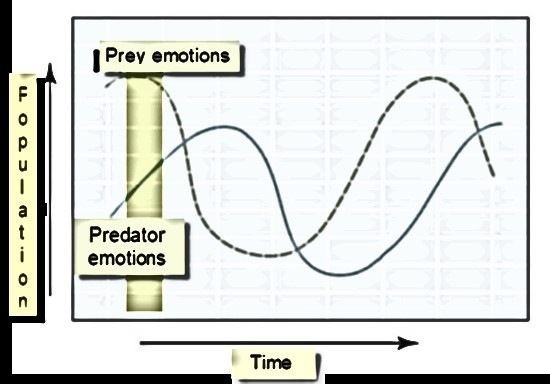

The journey of emotions affects our behaviors. This can be best to watch visually the wave of emotions in the stock markets worldwide. The emotions start with the intensification of the positive emotions until disappointment is encountered and expectations fall below their expectation lines. This leads to the generation of negative emotions intensifying until they carry the investor to a rock-bottom state and the investor’s positive emotions become the prey for negative emotions. When a ray of hope appears the re-birth of positive emotions start and a new wave of positive emotions build up.

The predator negative emotions feed on the prey positive emotions. This reminds me of the prey-predator relationship in which the predators eat up the preys until no or enough preys are available and the predators suffer from hunger. It is an indirect way of committing suicide.

We fall preys to our emotions and our behavior follows a wavy path. These waves can become turbulent and we need to surf their turbulence as if great surfers surf the turbulent waters.

Behind the scenes, emerge the paradoxes and biases. These factors do not work in isolation and affect each other by feedback. No wonder the stock markets have such complexity making the precise prediction of their movements and trends practically impossible.

Do authors and comments’ writer pass through the same wave structure? My answer is yes.

Conclusions:

· We need to reconsider the emotions affecting group thinking. There is diversity of hidden emotional factors that interact making the understanding of their outcome far more challenging than what appears on the surface.

· Changing the meeting place such as physical rooms, exchange rooms or virtual platforms affects the rate of changes. We shall observe the same wave patterns with their fractal and complex structures. Humans with the complexity of each person interacting with others count.

· It requires huge effort to think and interact with rationality in these meeting places.

· The few predators (the profit-making investors) that shall be happy to break the prey and cut them into pieces. This way they may enjoy having more “mouthfuls”.

· Worse is when investors, writers and comment writers become the prey and the preys at the same time. They all fall preys to their greediness for more success (readership for authors) and develop all or few of the complexities highlighted earlier in this post. They become like a serpentine biting their own successes and failures. This adds to the complexity of these markets (including Idea Markets) than what is experienced in simple prey-predator complexity.

· The sentiments that prevail in stock markets are indifferent from the sentiments of authors and readers and these sentiments shape up the mode of interactions between authors and readers.

· How do I try to buffer my complex biases and paradoxes by first reading the post and then comment before I read other comments? At least, I am not influenced by any other comment or the trend of the majority of comments. I admit my failure to do so sometimes.

I here confess that I experienced many of these paradoxes and biases. The best I could do is not to go to the extreme.

I have no complaint behind writing this post. Its publication coincides with the most complimentary comments I received over the years. I feel I am bloated with them. Therefore, the motive for writing this post is my search for answering the questions that are outlined in this post.

مقالات من Ali Anani

عرض المدونة

Organizations are like plants and forests- they all share initial growth, conservation, release and ...

A better description of the unknown-unknown quadrant in the Johari Window came to my mind upon obser ...

Last week I exchanged comments on the title of my post “Ideas Stock Markets”. The discussions center ...

المتخصصون ذوو الصلة

قد تكون مهتمًا بهذه الوظائف

-

Travel - Hotel invoice collection Associate

تم العثور عليها في: DrJobEn JO A2 - منذ يوم

PwC Madaba, الأردنNEXGEN Asset Management is looking for an experienced Software Our ideal candidate is a motivated, enthusiastic, and highly organized individual with a strong technical The Software Developer will work closely with the Implementation and Project Delivery teams and other departmen ...

-

Human Resources Operations

تم العثور عليها في: DrJobEn JO A2 - منذ 23 ساعة

pwc middle east Amman, الأردنPerform the HR Operations and other related tasks and assignments at high quality and on timely matter · Delivery day to day operational activities such as hiring approvals, enrollment of new employees, offboarding, payroll, employees' services and others · Follow the SOPs and pe ...

-

accountant

تم العثور عليها في: DrJobEn JO A2 - منذ يوم

Al-Zahraa Company Amman, الأردنAl-Zahraa Company for Decoration Works requires an accountant with a bachelor's degree in accounting and at least 3 years of experience Salary: 300 dinars Working hours from 9 to 5 Location: Jabal Amman, Prince Muhammad Street _ opposite Samir Al-Rifai Park _ Al-Weibdeh traffic l ...

التعليقات

Bill Stankiewicz

منذ سنتين #103

Well said Dr Ali

Bill Stankiewicz

منذ سنتين #102

People are creatures of habits, some good and yes some very bad

Fay Vietmeier

منذ 3 سنوات #101

Ali Anani

منذ 3 سنوات #100

Dear Edward Lewellen My friend- your comment is challenging. I love what you said ""The only true memories are the ones we haven't remembered". In emulation of the "observer effect". I would name this as the "memory effect".

John Rylance

منذ 3 سنوات #99

Thank you for explaining.

Ali Anani

منذ 3 سنوات #98

Just to highlight the name of John Rylance

John Rylance

منذ 3 سنوات #97

Thank you for your reply. It appears to me that you are suggesting that hypnosis is a means of releasing "stored thinking" i e a means of confirming what we thought happened. Memory being our main source of knowledge.

Ali Anani

منذ 3 سنوات #96

Edward Lewellen This comment coincides with the exchange of quite few messages between Harvey Lloyd and I. Your last paragraph about the efficacy of the unconscious mind is quite relevant to the exchanges I mentioned with Harvey, I shall refer to your notable comment soon in a post.

Ali Anani

منذ 3 سنوات #95

Harvey Lloyd I enjoyed how you described the birth of groups whether initiated by a motivated leader or "accidental" groups formed by an emotional leader with loos bonding among the members of the groups. In the first case the group has a direction to follow and so it enhances its chances of success. The second type of groups is closer to being chaotic than orderly and it is not surprising that they fall apart and abandoned. The success of the first type of groups is conditional to the members of the groups to free themselves from the biases mentioned in this post.

Ali Anani

منذ 3 سنوات #94

#94 Dears Harvey Lloyd Such rich ideas you bring to my mind. I know their harvest shall be fruitful. I plant seeds and a year layer I "I am sitting atop the ideas and thoughts of one year ago" And then ."Although I have ideas that have felled { can learn from the seeds of others that were unable to adapt and overcome. Wisdom is gained." There are ideas that we forgotten for as long as centuries and then a fresh mind in the right environment picks them and collect their harvest. The originator of the idea has not seen the harvest and others enjoying it. I am drafting a post for publishing next Monday on Circular Teams and Ideas, in emulation of Circular Economy. I hope the post shall reflect more on these discussions here.

Harvey Lloyd

منذ 3 سنوات #93

Harvey Lloyd

منذ 3 سنوات #92

Ali Anani

منذ 3 سنوات #91

Fay Vietmeier Harvey Lloyd I want to draw your attention to the remarkable comment of John Rylance This is a super-conductive comment and I shall build on it more ideas my friend.

John Rylance

منذ 3 سنوات #90

To be honest your interpretation had not occurred to me. Having read the two questions the answer is yes in both cases. Any comment made is open to interpretation, dependent on the the receivers view point. In this case you expressed curiosity, I just typed the first answers which came into my head, you put your "spin" on my off the cuff reply. The result between us we added a dimension to the post. On the topic of tree rings and what they tell us is only really visible once a tree is felled or dies. It's like holding a post mortem, or writing a biography of its life, what it has been through and changes it has experienced.

Ali Anani

منذ 3 سنوات #89

John Rylance To the opposite my friend as you inflated my curiosity. Your comment reminds me of dark and light colors in each ring of the tree, Now, you offer an explanation "nightmares are dark" whereas daydreams are light. Are these the equivalent of dark and light colors in the rings of trees> Are hard conditions that a tree faces during a season reflective of the harsh surrounding environment whereas light colors are indicative of the springtime? New added vet positively to my curiosity.

John Rylance

منذ 3 سنوات #88

Morpheus has woven his magic. Nightmares are part of stored thoughts in our brain, as are daydreams, former in the darkest part, while the latter are those lighter brighter thoughts that float around when we are positive. Hypnos didn't respond directly, claiming that that hypnosis had a bad press due to accusations that it took over our stored thoughts for its own ends. That it could help more with the past than the future. Does this satisfy your curiosity?

Ali Anani

منذ 3 سنوات #87

John Rylance As your nap is over I wonder if you have an answer. Curious to know

John Rylance

منذ 3 سنوات #86

#89 #88 Edward are nightmares "stored thinking"? Also are daydreams "stored thinking" as well. A final thought where does hypnosis come in our "stored thinking" Off for a nap, perhaps when I wake up I will have the answers.

Fay Vietmeier

منذ 3 سنوات #85

Edward Lewellen You are an attentive bee ;~) I am writing a post about thoughts as seeds ... and was wondering what you call this "download" of information at night, transferring that information from our unconscious to our conscious ... Does it have a scientific or medical name? I was considering calling it "answered thinking"

Ali Anani

منذ 3 سنوات #84

Thank you dear friend Edward Lewellen for taking care of my interests. Yes, your reply is more than helpful I am grateful to you.

Ali Anani

منذ 3 سنوات #83

Fay Vietmeier Thank you for the clarification. I have read the book of Tzu. Any strategist must be aware of his great thoughts. I loved how researches transformed his war strategies to business. I didn't know he coined this quote. It is so deep. Great comment my friend

Ali Anani

منذ 3 سنوات #82

Fay Vietmeier Here? I will check now

Fay Vietmeier

منذ 3 سنوات #81

Fay Vietmeier

منذ 3 سنوات #80

John Rylance Is a Light Bulb Moment the result of a creative thought or a creative idea? ... one can cause the other ... so both ;~) Are thoughts and or ideas the result of inspiration? ... without question ;~) Which are more life changing thoughts or ideas? ... again: one can cause the other ... so both I have not been in the sun at all ... which is where I'm soon headed ;~)

Ali Anani

منذ 3 سنوات #79

You are not alone out in the sun my friend. I assure you.

John Rylance

منذ 3 سنوات #78

#78 Questions for you both. Is a Light Bulb Moment the result of a creative thought or a creative idea? Are thoughts and or ideas the result of inspiration? Which are more life changing thoughts or ideas? I'm thinking the answers are in the cliche How long is apiece of string? Perhaps I've been out in the sun too long today.

Ali Anani

منذ 3 سنوات #77

Fay Vietmeier Now, I am smiling.

Ali Anani

منذ 3 سنوات #76

Fay Vietmeier This is a fresh look. Ideas can thinking can feedback to each other "Thinking can change the direction of Ideas And still IDEAS can change the way we think ;~)" Thinking drives ideas+- I just wonder how while asleep you dream of great ideas.Are these ideas the result of "stored thinking": The real issue is now it is not the chicken or the egg. It is bot thinking and ideas. You remember that Hairy ideas based-poem? I started drafting with whatever little time available writing lyrics for my post on Rings of Experience. This is just an idea! I like writing lyrics without interruption of thinking to the maximum degree possible.

Fay Vietmeier

منذ 3 سنوات #75

Fay Vietmeier

منذ 3 سنوات #74

Fay Vietmeier

منذ 3 سنوات #73

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee IDEAS are ideas And Thoughts are THOUGHTS Yes: “Thoughts and ideas are often used interchangeably” In truth: You can’t have one without the other ;~) ... kind of like love & marriage ;~) This is taken from a post in my “pearl-holder” IDEAS flow out of THOUGHT ... We can act on them ... or not Thinking drives ideas Thinking can change the direction of Ideas And still IDEAS can change the way we think ;~)

Ali Anani

منذ 3 سنوات #72

This time I agree in full. I must highlight here that some systems may appear deceptively simple,but in reality they are very complex. For example, fake news. The factors involved such as a host of biases on the individual level and on the societal level are so complex for even the most experienced. It may not be a choice for us to ignore complexity if we want to understand what type of thinking to apply including the three types you highlighted in your post and system thinking and complexity thinking. When many parties are interacting because of the social media effect we are progressively moving towards complexity and simple cause and effect analysis shall be offline.

CityVP Manjit

منذ 3 سنوات #71

I agree, because complexity thinking and fractals are well beyond the stock market of people. The metaphor for this type of thinking is in the world of derivatives and investment vehicles which themselves caused the 2008 crash. https://www.investopedia.com/financial-edge/0210/did-derivatives-cause-the-recession.aspx and the key part of this question is described as follows "Derivatives do ensure against risk when used properly, but when the packaged instruments get so complicated that neither the borrower nor the rating agency understands them or their risk, the initial premise fails." I too agree that we do not need to go here in this instance because this is not the stock market of the masses. The thinking I am talking about is the same one that created slavery and not humanity. We are already slaves to the machine, and complexity thinking takes us more towards the singularity than it does to a renaissance in humanity. https://singularityhub.com/2017/03/31/can-futurists-predict-the-year-of-the-singularity/ Complexity thinking does not prevent a dystopian future for mankind, our love of fractals is because we retain a dream of utopian society. When our world can not even deal with a complexity thinking phenomena like Covid-19, how is it going to deal with understanding complexity anytime soon? There is no evidence that Covid-19 was man-made, but in terms of application, it is in places like dystopian technology and military applications that the first major applications of complexity thinking will be found - because that is where the investment is. The stock market of people is far removed from that.

Ali Anani

منذ 3 سنوات #70

This shall take us into far more depth. I am referring to what has been popularized as "Complexity Thinking"/The world we live in has rising complexity because of increases interconnections. The sum of the parts don't equal the whole. So, delving into these topics will take us into new domains of thinking. The simplest reference to the complex systems and how they differ from other systems is well-illustrated in the cynefin framework. This type of thinking is beyond the scope of this post.

CityVP Manjit

منذ 3 سنوات #69

The reasoning I applied with this statement is that thinking can be measured and both critical thinking and creative thinking are defined forms of thinking. Data scientists can even extrapolate our behaviours from expressed thoughts. So what I am saying here is thinking is the measure that can be denoted a social price. It is not to say that an ideas stock market cannot be formulated, they can - but today we can measure the quality of critical thinking, as well creative thinking. I am saying that measure of three different types of thinking are possible for we can measure low value thinking, compared to high value thinking. What these measures are measures of thinking skills which change how ideas are applied and shaped. We can test for these thinking skills and where data science can measure this - one can measure the social price of that thinking.

Ali Anani

منذ 3 سنوات #68

A friend has just messaged me asking what exactly I ddn;t agree with in CityVP Manjit post. Well, for the benefit of the readers it is this line: "Ali Anani is on the right lines to think about an "ideas stock market" but it is not ideas that is the measure but thinking". I I find this difficult to absorb or approve. Thought (also called thinking) is the mental process in which beings form psychological associations and models of the world. Thinking is manipulating information, as when we form concepts, engage in problem solving, reason and make decisions. Thought, the act of thinking, produces thoughts. https://en.wikipedia.org/wiki/Outline_of_thought Thoughts and ideas are often used interchangeably. Few references mention a difference that exists between them: Idea vs Thought Idea and Thought are two words that are often confused when it comes to their meanings and connotations. Idea refers to a plan or a process that occurs in the mind in relation to the completion of a work or duty. Thought on the other hand is a mental process that keeps on going in the mind unabated. https://www.differencebetween.com/difference-between-idea-and-vs-thought/

Ali Anani

منذ 3 سنوات #67

Fay Vietmeier "... it is not ideas that is the measure but thinking" I simply respectfully disagree as per my previous comment No. #68

Ali Anani

منذ 3 سنوات #66

I should have spelled Gandhi this way in my previous comment. Sorry for this.

Ali Anani

منذ 3 سنوات #65

Fay Vietmeier I read all your comments tonight on LinkedIn as well as your comments here. In my post of today Rings of Experience https://www.bebee.com/producer/@ali-anani/rings-of-experience I showed a concentric view derived from nature core values and how their subsequent effects, including our thinking .This post is only the introduction for my next post to expand more on this idea. In the important post of CityVP Manjit as an offshoot of this post changed my title to his thinking styles. I agree basically with Manjit. However; ideas,and thoughts are derived from our beliefs. This is what Ghandi said n his famous quote: your beliefs become your thoughts. This is reflected well in my post of today. Ideas is how we process thoughts that are generated from our beliefs. Now, what type of thinking we apply to the ideas comes after Belief and NOT before it. I shall explain with visuals in my next post. Edward Lewellen mentioned the core identity and he is spot on. I shall add this to the concentric rings in my next post. .

Fay Vietmeier

منذ 3 سنوات #64

CityVP Manjit 4) You say: “We need to find and reach the individual in humanity but we focus all our time in making our thinking individual,when we need to merge our thinking into a whole perspective - in order to liberate our humanity! We think as individuals because we are ;~) Now if married ... and “two become one” ... that (should) change thought & action Orientation to self ... selfishness is what we need to be aware of ... and BEWARE of We should consider others & have a holistic understanding about our state of being Think of our part in the whole ... develop a perspective that sees to & beyond the end I call this "eternal perspective"

Fay Vietmeier

منذ 3 سنوات #63

CityVP Manjit These points are EXCELLENT ... worthy of a book ;~) ... it is not ideas that is the measure but thinking ... It is the effects of living too fast which has impeded critical thinking skills, but it is also due to too much information flow, ... so why have we entered an age where fake news is so rife and critical thinking can be viewed today as the Great Depression Era of Critical Thinking ... The irony of course is that as we develop worse rather than better critical thinking skills, we do not have the critical thinking to determine that question ! ... an over-reliance born of a 20th Century focus in Universities on a bias for argument, reasoning and getting marks for backing up your sources ... stupidity is a profitable commodity in a market that today profits from stupidity ... investing and arming ourselves with critical thinking skills. The reason for that is simple, 90% of us are terrible at reflection ... To understand the place of critical thinking we need to be self-aware ... we just do not invest the effort to be self-reflective enough to be able to transform our own thinking ... turned education, health and media into battle grounds rather than centers of wisdom.

Fay Vietmeier

منذ 3 سنوات #62

CityVP Manjit Since your post "The Stock Price of Thinking" link is shared here ... I'm sharing these on comments which I made to your LI /checked but did not see on beBee Thank you Manjit ~ excellent, thought-provoking post Discernment is a precious gift ... as is the ability to THINK: critically ... creatively ... contextually Information should not be confused with wisdom, TRUTH or knowledge ... although if one has discernment, knowledge & wisdom can be gleaned from “information” There are two books that came to mind as I read ... which speaks into the ability to THINK (and how one is robbed of that ability) Amusing ourselves to Death by Neil Postman speaks presciently into how entertainment would corrupt truth & learning ... the ability to THINK And Not a daycare ~ The Devastating Consequences of Abandoning Truth 2) This side note: I find it relevant that in the Bible: information overload is written about

Fay Vietmeier

منذ 3 سنوات #61

Edward Lewellen Rich insight that you offer: "When a person has Personal Power through their Core Identity, they don't fear feedback, discussion, or even confrontation ... Confusion is a HUGE issue in culture ... in the world (the root is spiritual condition) How often do people confuse who they are ... with what they do "Knowing your Core Identity is central to having personal power and influence." ~ Edward Lewellen Blessed are you ... if you know who you And Whose you are ;~) "Shallowness is spreading ~ @Ali Anani "Confusion is spreading like wildfire" ... fem-v

Fay Vietmeier

منذ 3 سنوات #60

CityVP Manjit Summary comment: You say: “We are not free thinking individuals and if we seek context through reflective thinking, our reflection ironically falls into the quicksand of controlled and conditioned thinking, Based on free will my observation is that people are indeed: “free-thinking” The real question ... the real challenge of change is your level of consciousness ... The lowest level of consciousness is unconscious incompetence ... in essence, this person does not know that they don not know ... this can be likened to walking in the dark The greatest achievement of humanity is not in technology, art or science. It is in the growing recognition of its own ego-based dysfunction. How we communicate has everything to do with our level of consciousness. No one can act beyond their level of consciousness. The dysfunction of our ego-based mind has been magnified through science and technology.” ~ Phil Johnson We should consider the value of thought as regards destiny of humanity Very insightful what you identify as value destroyers: they are THIEVES CONTROLLED THINKING CONFLICTED THINKING CONDITIONED THINKING

Ali Anani

منذ 3 سنوات #59

@EdwardLewellen I am quite familiar with your work on core identity. So, what you are saying here is that people who lose such an identity are prone to all the biases mentioned in this post. This is food for thought my friend. I shall ponder on it over the next few days. I shall

Ali Anani

منذ 3 سنوات #58

John Rylance I published today a post and I am sure you may enrich the discussions there as you do here https://www.bebee.com/producer/@ali-anani/rings-of-experience#c1

Ali Anani

منذ 3 سنوات #57

HaHa my good friend John Rylance You remind me of a friend of mine who published his poems in a book. Before publishing he asked me if f I would write the forward for his book. I accepted. My friend was a banker. So, i wrote about the paradox of a banker being a poet as well; So, Yes it is a paradox. Actually, my good friend too Fay Vietmeier and I started publishing co-authored poems mixing science and poetry (scietry- mixing science and poetry

John Rylance

منذ 3 سنوات #56

#52 perhaps poetic bias/paradox should be added to the list, or would it Ali be musical bias/ paradox.

Ali Anani

منذ 3 سنوات #55

CityVP Manjit I have just commented on your post again as follows (because I think my comment is of relevance here too) You listen my friend because the post is clearer now with the added summary. I like the graph you added in the summary because it summarizes your thoughts on thinking very well. I feel a good title to combine your post and mine is "The commercialization of Thinking". Now, which type of thinking this is I leave that to you.

Ali Anani

منذ 3 سنوات #54

Great and I shall read your post again, as I keep doing. Yes, this summary cements the idea of your post. well-done. I just wonder if you are dear CityVP Manjit. This is because of your writing "We have used critical thinking to control, marketers have used creative thinking to condition us to turn our life into a commodity and religion has created conflicted thinking because we have replaced freedom with dogma

CityVP Manjit

منذ 3 سنوات #53

Ali Anani

منذ 3 سنوات #52

CityVP Manjit

منذ 3 سنوات #51

That was what is peculiar, I changed them from .png to jpeg but nothing I tried loaded. I went to see a prior post to test this out by removing an existing image but when I tried to replace the image I had deleted, it was still not loading. I will try again in a few days otherwise I managed to copy it over and thank you for your response.

Fay Vietmeier

منذ 3 سنوات #50

John Rylance John ~ great comment ;~) ... even "poetic" This writer CONFIRMS trying to fully understanding this piece has revealed his BLIND SPOT. The result is I find it difficult to CONFORM and join the BANDWAGON with nothing on which to ANCHOR any views. Unless I follow an ABILENE PARADOX, which could trigger an IMPOSTOR PARADOX , and reveal my KNOWLEDGE INFERIORITY PARADOX about this subject.

Ali Anani

منذ 3 سنوات #49

I deleted my comment because of the spelling mistakes. John Rylance What music your comment is! You summarized the paradoxes neatly in your comment and then you say you don't fully understand the post. I love your spirit in writing this comment. I hope that Fay Vietmeierr would respond to your poetic comment.

Ali Anani

منذ 3 سنوات #48

John Rylance Ehat music ypur comment is! You summarized the paradoxes neatly in your comment and then you say you don't fully understand the post. I love your spirit in writing this comment. I hope that Fay Vietmeier would respond to your poetic comment.

Ali Anani

منذ 3 سنوات #47

Fay Vietmeier I agree in full As simple as that. The writer invites the readers to his post. The post maybe to to their taste and may not. The reader has ways of expressing satisfaction or dissatisfaction in whatever we the readers wishes. I don't think authors have this freedom Now, on my way to read CityVP Manjit post on LinkedIn

Ali Anani

منذ 3 سنوات #46

Thank you CityVP Manjit I shall proceed to LinkedIn now. By the way make sure the images ate in JPEG format. If not, they fail to load

John Rylance

منذ 3 سنوات #45

Fay Vietmeier

منذ 3 سنوات #44

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee Thanks Professor for clarifying ;~) I somewhat elaborated on that ;~) in reverse ;~) Perhaps I missed it but is there a “paradox ... a bias ... an effect ... a syndrome” that describes the un-engaged bee: they read and leave no comment or they comment & you respond but then you are left hanging by one wing ;~) I find this bee-behavior a bit “bee-wing-ruffling” ... ... a thoughtful comments deserve thoughtful responses ;~) ... ignoring replying to a reader is "a terrible" response ... I call this "bee-shunning" Now there always looms the possibility that something "terrible" happened and the author is unable to respond ... I do recognize bees are busy ... but ;~) it takes very little time to type a thought ;~) ... even if it is not “sweet” (in the event what a bee writes is not well-received) And When people read but neglect,to at the very least, hit “relevant” From my naïve way of thinking ... a bee took the time to put thoughts into a post ... the very least a reading bee one can do is hit “relevant” But, I recognize there are times this is just an oversight ;~) +1

CityVP Manjit

منذ 3 سنوات #43

Hi Ali Anani - I tried posting this on bebee but I could not load any images and it does not allow posting without an image. So I have copied everything over to LinkedIn and posted there. My Paradox Wisdom is called "The Stock Price of Thinking" https://www.linkedin.com/pulse/stock-price-thinking-cityvp-manjit

Ali Anani

منذ 3 سنوات #42

Fay Vietmeier No,I meant exactly the opposite. The writers make the reader feel unimportant when they ignore replying to comments. Reading a post is an experience for the reader.Why should a writer make it salty by ignoring the reader? It is the opposite- the author should be grateful to the reader to engage and comment. Ignoring replying to the reader is a bad habit in my view. Actually, a terrible one.

Fay Vietmeier

منذ 3 سنوات #41

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee I’m not sure I understand what you’re saying here? “It amazes me though why writers make the readers' visit to their publication a little sour because they don't care to respond. It is better in the cases jur not to all for writing comments. As simple as this is.” I can see how the readers might make the writer “a little sour because they don’t care to respond” I was going to omit expressing this but I think it applies: Perhaps I missed it but is there a “paradox ... a bias ... an effect ... a syndrome” that describes the un-engaged bee: they read and leave no comment or they comment & you respond but then you are left hanging by one wing ;~) I find this bee-behavior a bit “bee-wing-ruffling” ... ... a thoughtful comments deserve thoughtful responses ;~) I do recognize bees are busy ... but ;~) it takes very little time to type a thought ;~) ... even if it is not “sweet” (in the event what a bee writes is not well-received) And When people read but neglect,to at the very least, hit “relevant” From my naïve way of thinking ... a bee took the time to put thoughts into a post ... the very least a reading bee one can do is hit “relevant” But, I recognize there are times this is just an oversight ;~)

Ali Anani

منذ 3 سنوات #40

It amazes me though why writers make the readers' visit to their publication a little sour because they don't care to respond. It is better in the cases jur not to all for writing comments. As simple as this is. I meant it is better in this case not to allow for commenting. I don't know I typed what is in the revised version dear Fay Vietmeier

Ali Anani

منذ 3 سنوات #39

Thank you for sharing your thoughts Royce Shook. So, we agree on the content.

Royce Shook

منذ 3 سنوات #38

Ali Anani

منذ 3 سنوات #37

Fay Vietmeier Thank you dear Fay for your continued engagement. You wrote "There is so MUCH we simply do NOT know". You simply read my posts before I even publish them! My next post is simply a proof of what you said. I plan to title it "I hope you did' not guess it) "The Rings of Experience and Ignorance". It t uses few metaphors from nature to explain. I shall visit all the links suggested by you in your comment. It amazes me though why writers make the readers' visit to their publication a little sour because they don't care to respond. It is better in the cases jur not to all for writing comments. As simple as this is.

Fay Vietmeier

منذ 3 سنوات #36

CityVP Manjit I enjoyed your critic of this post ... great perspective you offer ...totally different in style did not create cognitive dissonance, because the richness of the content was amazing. ... Unfortunately we live in a society where the people who need to know about these logical fallacies are the one's not touching this content because their minds are already made in the oily slipperiness of short-term attention. Once the opening was reconnected with the surprise in the body, the closing of the post brought us back to a style we recognize. ... that is the genius of this particular post - to make us question our own group-think habits and be welcoming of change "logical facilities" ... we all have them ... but are we willing & honest enough to examine if they are to our detriment ;~)

Fay Vietmeier

منذ 3 سنوات #35

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee "The higher level we go, the more energy *kinetic energy) we spend. It takes effort to get there." The question is always do we want to get there ;~) Am I willing to do the push-ups that are required? From what I know of the "student" in you ... exploring NDE would open many new thought-paths my dearest Professor ... science is ever-present in the research It has made me consider things I have not pondered before ;~) There is so MUCH we simply do NOT know I encourage at least watch the video below (there are many others with Dr Alexander) There is much research on NDE"s (near death experiences) that are illuminating scientific perspective about the brain & spirit I responded with a couple lengthy comments to Dr Ian on this post (#6, #7) ... as yet, no response https://www.bebee.com/producer/@ian-weinberg/our-very-own-psychosis Dr Eben Alexander, neurosurgeon ... NDE experience (have read his books: Proof of Heaven & Map of Heaven) this due to his mention by @Cyndi wilkins (this is one interview/there are MANY) https://www.youtube.com/watch?v=4MwnxDK3IxY (approx. 30 minutes) ... compelling, trans-formative He mentioned: Recent Book: The Science of NDE - Missouri Medical Society https://www.msma.org/near-death-experiences.html "New world view evolving: science & spirituality ... talked a lot about quantum mechanics ...

Ali Anani

منذ 3 سنوات #34

CityVP Manjit W.O.W I am just curious to read your post dear Manjit. I am on my toes.

CityVP Manjit

منذ 3 سنوات #33

Ah! I absolutely think you are on the right track - but for me to show you how right that track is, I need to publish another Paradox Wisdom. It will take a little time today to prepare it but when I link it, you will not just be overjoyed but you will be saying YES, YES, YES. Will be back with the link when I finish.

Ali Anani

منذ 3 سنوات #32

CityVP Manjit This is corona time and a friend of mine saw the content. Immediately, he proposed the postponement of its publishing. So, as I am too, shocked by your comment in the most delightful way. I feel satisfied that I published the post. Like you mentioned "their minds are already made in the oily slipperiness of short-term attention" and the timing of publishing will nor change tjeir lack of attention.. I must admit that the warmth of your words filled me with satisfaction and delight. This post has drained my energy to write and put it in a format so that it may be used as a reference for biases and paradoxes. Moreover;; I believe that no one else has described the movement of stock prices in any visual form to include biases and fears. I also thought that as we are all writers and/or readers this post would get more attention. But one loud voice of appreciation such as yours made me feel the efforts I made were worthy. I can't thank you enough. I appreciate every word in your comment.

CityVP Manjit

منذ 3 سنوات #31

I am shocked but in a most delightful way - because when I saw the write up on LinkedIn the last thing I would envisage is that the post would be about logical fallacies. So as I came to beBee I did not expect this. Now compound this that this is totally different in style did not create cognitive dissonance, because the richness of the content was amazing. Having known about the existence of logical fallacies for some time, I find the sheer number of fallacies to end up becoming dry as a means of exploring them, but not so because this post bounced with the flow of narrative - a juxtaposition to a starting point where one expected the argument to be built up layer by layer, and certainly not in the twist maker ability of a screenplay writer. For sure Hollywood has the ability to surprise us because they are masters of the human condition, and magicians surprise us because they know every trick of the mind but neither have made a movie or a magic show about logical fallacies. Unfortunately we live in a society where the people who need to know about these logical fallacies are the one's not touching this content because their minds are already made in the oily slipperiness of short-term attention. Once the opening was reconnected with the surprise in the body, the closing of the post brought us back to a style we recognize. Yet that is the genius of this particular post - to make us question our own group-think habits and be welcoming of change - especially one that turns out to be as wonderfully enlightening as this buzz.,

Ali Anani

منذ 3 سنوات #30

SMILE Fay Vietmeier The first thing I am doing is to reply to your comment spirit mentor- I am smiling because you wanted to explain on a topic that your familiarity with is many times greater than mine! What to add? The higher level we go, the more energy *kinetic energy) we spend. It takes effort to get there. And you explained why.

Fay Vietmeier

منذ 3 سنوات #29

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee We are a "pairing of minds" my dear Professor You say: "The highest level of activation is spiritual activation." I believe this to be true ... for we are spirit beings At the fall of man the flesh gained authority over the spirit Thus we have to be intentional ... for the spirit to be in authority Being "born again" is a catalyst Outcomes depend on our cooperation with the Holy Spirit Before I blinked ... I was going to ask you what scientific evidence you may offer about this: "The highest level of activation is spiritual activation." There is much research on NDE"s (near death experiences) that are illuminating scientific perspective about the brain & spirit I responded with a couple lengthy comments to Dr Ian on this post (#6, #7) ... as yet, no response https://www.bebee.com/producer/@ian-weinberg/our-very-own-psychosis Dr Eben Alexander, neurosurgeon ... NDE experience (have read his books: Proof of Heaven & Map of Heaven) this due to his mention by Cyndi wilkins (this is one interview/there are MANY) https://www.youtube.com/watch?v=4MwnxDK3IxY (approx. 30 minutes) ... compelling, trans-formative He mentioned: Recent Book: The Science of NDE - Missouri Medical Society https://www.msma.org/near-death-experiences.html "New world view evolving: science & spirituality ... talked a lot about quantum mechanics ... "We are spiritual beings "

Ali Anani

منذ 3 سنوات #28

Fay Vietmeier Before you respond I bit my friend that you are adding to the pearls-folder "The highest level of activation is spiritual activation:.

Ali Anani

منذ 3 سنوات #27

Fay Vietmeier

منذ 3 سنوات #26

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee I am SMILING Now I'm thinking like a scientist Wondering how humans can boost "activation energy" I know its not available on Amazon '~)

Ali Anani

منذ 3 سنوات #25

Fay Vietmeier I agree with your comment as is. Yes, engagement needs what we call in chemistry activation energy. If this energy is insufficient no reaction shall take place. The activation energy for people differs widely. In most cases it is not enough. The proof is that engagements on posts rarely reaches even 1%. That is one comment from one hundred readers. On the other scale there are people like you who reach their engagement because YOU CARE.

Fay Vietmeier

منذ 3 سنوات #24

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee Actually this question ties in with your post ;~) I too wonder about intentions ... reasons for sharing Totally agree that receiving feedback as to why the share is of value I try to remember to provide a reason ... even if only a few words ... but your comment here will prompt me to do better in the future I do think that overall: it is the unique quality of each person reading ... and commenting that will shine forth or NOT In reality, some people are just more thoughtful than others ... plus (again) the constraints of time & attention ... value ascribed to what is written

Ali Anani

منذ 3 سنوات #23

Fay Vietmeier You know dear you alert me to a good question? When people share a post? - maybe so they may re-share theirs - got excited by the post and couldn't resist sharing it - it serves some of their opinions and the reader want to make this known to as many people as possible in appreciation for the energy that was clearly spent on writing the post - direct request through messages urging them to share the post I am sure there are other reasons. This is why I like re-shares with comment explaining why this post is being shared. I wonder if you agree.

Fay Vietmeier

منذ 3 سنوات #22

Ali \ud83d\udc1d Anani, Brand Ambassador @beBee How often there is no feedback ;~) Or someone just hits + + is fine ... but engagement ... genuine feedback takes time & energy ... Some will deem it worth time and energy ... others not and as our bee-friend Jerry Fletcher says "and so it goes" Sharing this rich, thought-provoking post with "students" ... much to be gleaned ;~)

Ali Anani

منذ 3 سنوات #21

Ali Anani

منذ 3 سنوات #20

Fay Vietmeier Totally agree with you. Feedback has a purpose and if we dob't write what we think then it is misleading feedback. How could we improve without credible feedback?

Fay Vietmeier

منذ 3 سنوات #19

Zacharias \ud83d\udc1d Voulgaris I appreciate your wisdom Zacharias "When I share an idea with someone else I don't become "poorer" of that quality; we both become richer in it (at least potentially). That's something that makes idea-sharing more sustainable and greatly beneficial." ... may it be ;~)

Fay Vietmeier

منذ 3 سنوات #18

John Rylance You made me SMILE ;~) My response was similar but worded differently ;~) "Reading this I felt as if I had opened a cupboard and the contents poured out on to the floor."

Fay Vietmeier

منذ 3 سنوات #17

Ali Anani

منذ 3 سنوات #16

Ali Anani

منذ 3 سنوات #15

Kalli Born

منذ 3 سنوات #14

Ali Anani

منذ 3 سنوات #13

Ned McDonnell " Love your analogy. You do have a vivid imagination. I like how you related your comment to the stock market. This way you didn't distort the discussions and set them off-course. To the contrary you solidified the discussions. That enables me invest a tiny amount to keep me in the market, but not enough for me to diminish my credibility. Thus I defer the pay-up of time to read and study the comment or post until later". This is a very wise approach. I hope readers would do the same. Thank you for your comments enriched the post immensely..

Ali Anani

منذ 3 سنوات #12

Ned McDonnell I thank you for sharing your comment on LinkedIn here as well It is a glorious comment. Zacharias \ud83d\udc1d Voulgaris- this is the comment I mentioned earlier I responded to Ned's Comment: This comment rings so many bells. I am smiling because you wrote "I like the inventiveness of your analogy. Unfortunately, I can only go so far with itr:. So, in reality you are taking a risk by commenting even though this is how far you can go. I tell you that I am glad that you took the risk and write such a hugely-relevant comment. You added extra dimensions to the post. I want to share one example. Many readers shall not take this risk for fear they may look "below par" and expose themselves by writing irrelevant comments. So, a reader ban be passive by not commenting and this is risk-aversion. So, as the stock markets are, there are intangible losses such as risking reputation. Do you agree? I shall comment more later with more on your attention-grasping comment.

Ali Anani

منذ 3 سنوات #11

Zacharias 🐝 Voulgaris

منذ 3 سنوات #10

I would but these days I'm on a LI detox :-)

Ali Anani

منذ 3 سنوات #9

Just a quick response for now If you would just read the comment of Ned McDonnell on LinkedIn and compare the two comments.

Zacharias 🐝 Voulgaris

منذ 3 سنوات #8

Ali Anani

منذ 3 سنوات #7

I should have also thanked you for your reshare of the post John Rylance

Ali Anani

منذ 3 سنوات #6

John Rylance I fully understand. I know this post is fat. However; I decided to keep the integrity t he post and not publish in two or even three parts. The fact that you want to review your comment to do self-probing means that the post triggered you do to this self-appraisal. This is one of my objectives. I am glad to read your comment.

John Rylance

منذ 3 سنوات #5

Ali Anani

منذ 3 سنوات #4

Ali Anani

منذ 3 سنوات #3

Zacharias \ud83d\udc1d Voulgaris Thank you my friend and I look forward to reading your impressions.

Zacharias 🐝 Voulgaris

منذ 3 سنوات #2

Sure. Will get to it later today, after my webinar this afternoon. I look forward to reading this!

Ali Anani

منذ 3 سنوات #1