The Complexity of Taxes

Is there any similarity between taxes and stress? This question leaped in my mind as I was reading a post by Jerry Fletcher titled “Consultant Marketing Napkin Diary”. This buzz reminded me of the “Laffer Curve”, which was first drawn on a napkin. In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of government revenue. It illustrates the concept of taxable income elasticity—i.e., taxable income changes in response to changes in the rate of taxation. I have drawn the curve as below:

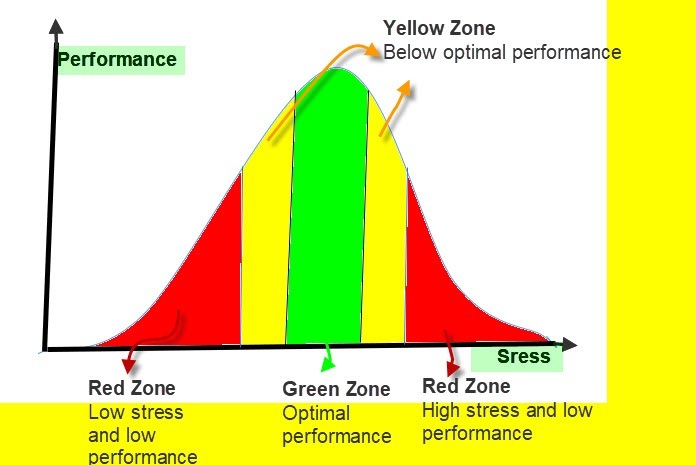

This curve is very similar to the stress- strain curve. In both curves- the performance of the a government to collect tax revenue is divided in the red zones, yellow zones and the green zone. There is an optimal level of collecting taxes as there is a peak performance expected from employees only when exposed to a certain level of pressure and then their performance drops sharply till it becomes poor.

I am asking if a good metaphor for governments to collect taxes is the Yerkes-Dodson stress curve? If the two curves represent the performance under stress- either the stress imposed on employees or the stress imposed on tax-payers by governments? In line with this metaphor is my reading “However, the Laffer Curve actually discourages taxes that are too low or too high. However, the Laffer Curve actually discourages taxes that are too low or too high. The social effects and feedback from the increased governmental taxes and like performances, the capacity to accommodate taxes and pressure reach their optimal effect” There have been many attempts to find a suitable metaphor for the collection of taxes, which reflected different attitudes on taxes. Some of these metaphors are:

Text are thefts or thefts or charity

Beer Is Not A Metaphor for Tax Fairness - Forbes

A useful metaphor for understanding the disproportionate damage to economic efficiency caused by rising taxes is the noise-to-signal ratio. For example, if the income tax rate is 10%, you keep 90% of your income. The noise-to-signal ratio is .111 (or .1/.9). Taxes behave like noise in a signal.

One other idea that popped up in my mind is to imagine the “Cynefin of Taxes”. In their efforts to improve the collection of taxes governments tend to increase the huge number of tax-payers, the collection systems, the control of payment of taxes and many other procedures. This leads to turning the simple systems of tax-collection from simple to complicated to complex and then this tend to become chaotic. What applies to simple system doesn’t apply to complex systems, to give one example. This leads to fruitless efforts by governments because they fail to understand the human behavior and its loss in filling vague tax forms. The tax-complex system instead of becoming a self-organizing one tends to become self-destructive one. The result is the need for a new system to emerge or an endless chaos shall result. A very agreeing point of view that I find representing this thinking is this reference. It states that “…as complexity of a system increases, the costs associated with it increase exponentially to the point where the costs approach infinity, and collapse is a certainty”.

It amazes me how much governments need to understand the value of simplifying the tax systems and understand the behaviors of the tax-payers.

مقالات من Ali Anani

عرض المدونة

Creativity is like scattered light going in different directions first to explore and observe in sea ...

It is amazing how ideas emerge! I was researching for the different plant metaphors that people sugg ...

Light and darkness co-exist anywhere and at any time. They exist in our bodies. The shadow is mostly ...

المتخصصون ذوو الصلة

قد تكون مهتمًا بهذه الوظائف

-

CS Team Manager

تم العثور عليها في: DrJobEn JO A2 - منذ 20 ساعة

Amazon Amman, الأردنLeading and developing a team of 20-30 associates; responsible for the overall performance management, coordination and evaluation of the team. · Actively participate in and drive the continuous improvement culture through 'kaizen' and lean projects. Identifying and eliminating b ...

-

After Sales Maintenance

تم العثور عليها في: DrJobEn JO A2 - منذ 3 أيام

Sports 4ever Amman, الأردنNeeded After Sales Maintenance who has the following " : · Minimum 3 years' experience in all kind of maintenance specially for Sports equipment's , · Good in English and willing to learn through E-Learning · Has driving license · ...

-

Senior Social Media Specialist

تم العثور عليها في: Manatal GBL S2 T2 - منذ 3 أيام

Whitecollars Amman, الأردنCompany Overview: · Our client is a Jordanian startup digital marketing agency specializing in providing cutting-edge solutions to businesses seeking to enhance their online presence. Our client offers a comprehensive range of services including SEO, social media marketing, conte ...

التعليقات

Ali Anani

منذ 4 سنوات #21

Ali Anani

منذ 4 سنوات #20

I believe some governments make the tax system more complex intentionally to confuse the tax payer and rob him/her of more money. It is paradoxical that a tax-payer has to pay while suffering as well. Paying taxes is painful; more painful is robbing using the given authority to do so. Thank you Timothy welch for sharing the buzz as well.

Ali Anani

منذ 4 سنوات #19

Your comment put a smile on my face dear Debasish Majumder. When the Laffer Curve was drawn on an envelope to the late president Reagan he decided not to raise the taxes. Taxes, like prices, have their elasticity. This means that the tax reach a maximum and then decline because they no more become responsive to tax increases. yes, who pays the taxes? I know of examples that the profit-makers found many ways to avoid paying their fair share. I thank you also for sharing the buzz.

Debasish Majumder

منذ 4 سنوات #18

Ali Anani

منذ 4 سنوات #17

Jerry- indeed, the best thing to say is "and so it goes".

Jerry Fletcher

منذ 4 سنوات #16

Ali Anani

منذ 4 سنوات #15

#16 -b the attitude towards taxes shapes our thinking about them. Which is worse theft or charity versus ransom?

Bill Stankiewicz

منذ 4 سنوات #14

Pascal Derrien

منذ 4 سنوات #13

Ali Anani

منذ 4 سنوات #12

Ali Anani

منذ 4 سنوات #11

Kevin Baker comment

Ali Anani

منذ 4 سنوات #10

My cousin closed shop for the same reasons that you mentioned in your comment Paul Walters. When taxes become a burden and pile up one little more tax will make the tax-player so distressed to keep the business running.

Ali Anani

منذ 4 سنوات #9

Ali Anani

منذ 4 سنوات #8

Paul Walters

منذ 4 سنوات #7

Ali Anani

منذ 4 سنوات #6

Thank you dear Tausif Mundrawala for commenting and sharing the buzz. There is an agreed experience that taxes forms get more difficult to understand because of the introduction of many agencies. You are lucky to specialize in this field. What I wanted to highlight in this buzz is that taxes are widely confusing of their value. The attitudes, as reflected by metaphors for taxes, include that they are charity, theft and social due. I found it interesting that the stress curve resembles the Laffler Curve meaning that they behave similarly and are both exposed to different sources of pressures such as social pressures, attitudes pressures and misconception pressures. The climate of the taxes is as complicated as the atmospheric climate and predictability of its performance becomes hard to do. I thank you for sharing your experience and for contributing a thoughtful comment that prompted me to reply in some detail.

Ali Anani

منذ 4 سنوات #5

it amazes me how VUCA applies to taxes. Volatility, uncertainty, complexity and Ambiguity are also characteristics of taxes as they are of the world today. I hope you get your reward sooner than later.

Harvey Lloyd

منذ 4 سنوات #4

Here in the US taxes are rewards for contractors (Civilian and Military), research grants Job postings and many other dynamics that are all hidden in subterfuge. In the heat of the battle between me and the CPA firm i have a hard time shaking the thought of where was the "T" man when i needed money, resources etc.... I can't complain, this go round of tax policies i have been rewarded. Generally though the reward runs out and i lose my turn. It will be someone else's turn next time.

Ali Anani

منذ 4 سنوات #3

Ali Anani

منذ 4 سنوات #2

I wish the "Tea" man would rather stand for the "Tea Man". Yes, taxes are rewards, but for whom? The tax system is getting complicated . It is a punishment to pay taxes and be punished for filling complex forms. The tax system is moving towards complexity and that is why the cynefin approach may help us in our comprehension and therefore simplifying the system. It is an interesting idea to see taxes as a reward, but at what price. This is a challenging idea my good friend, Harvey.

Harvey Lloyd

منذ 4 سنوات #1