FIREWORKS!! Gold, Silver, Cryptos, & the Toxic Dollar

Based on FIREWORKS!! Gold, Silver, Cryptos, & the Toxic Dollar

interview by the Wild West Crypto Show

July 4, 2020

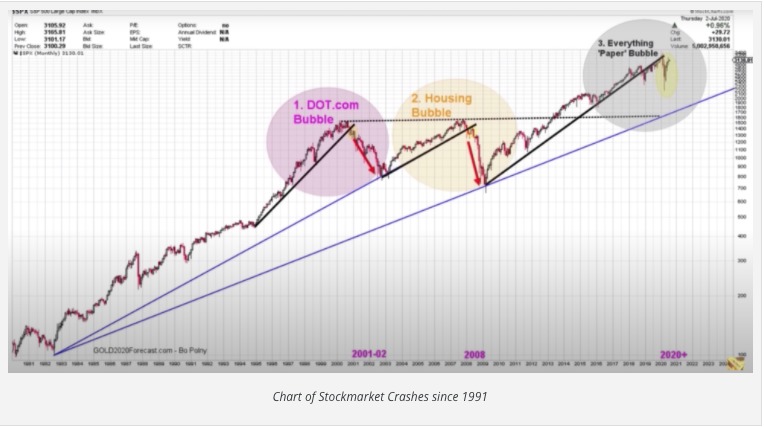

I put together a few charts to help us visualize the historical patterns we have experienced in the rise of gold and silver markets. This first chart shows a history of stock market crashes. It begins way back in 1991, and the first crash we see is the DOT.com bubble, which occurred in 2001-2002. From there, we see the market recover and begin to rise again until the housing bubble crash in 2008. The final crash is then the Everything “paper” bubble that we’re currently experiencing.

Now overlapping that with my second set of charts documenting the growth of gold and silver on the market, you’ll see that gold and silver never develop and start a bull market until there’s a stock market crash to instigate it.

Looking at these charts, you can see the crash in 2001-2002 occurred, and that started the bull market for gold and silver. Silver increased by 400%, and gold rose by 300% topping out in 2008. And what happened in 2008 after that? The housing bubble crash which set the stage for another bull market for gold and silver. On this run, gold rose from its lows, approximately 200%, and made a high in 2011. Silver on the hand outperformed gold and increased 430% to almost 440% in that rise. Both crashes created vertical price movements for gold and silver.

Now we have just had the 2020 Coronavirus crash. That crash now sets the stage for another bull market for gold and silver. This time, the only difference is we have cryptocurrencies tied into the mix, which we didn’t have in the other two. So now gold, silver, and cryptocurrencies are off to the races in another bull market. Each bull market has been prefaced with a market crash. This is a crucial point in our world right now for gold, silver, and now cryptocurrencies. All these reports, all the indicators in the cycles that I run, are pointing to a bull market.

In previous interviews, I forecasted a market high for gold and silver in June, and I’d like to add some clarity here. The month of June came, and gold topped out in the 1775 range. It’s been stuck for the past week and a half. But to clarify, gold and silver did not explode high enough. They were supposed to smash it down off a spike. So the downward movement that we’ve had is nothing but a move sideways. Gold and silver did go up, there was a high in June, but it wasn’t as high as it should have gone. So there is another vertical move coming in gold, silver, and cryptocurrencies. All it did was create a sideways price motion. There is another move coming. Gold and silver are stuck right now, but there are a lot of buyers out there, and the people that have been controlling gold and silver for generations are having some issues. There are too many physical buyers, and those in control are trying to cap the price. So we’re at a very exciting point with gold and silver, and cryptocurrencies are tied in with that. They all have bull markets; no matter what they do, they have bull markets. If you look back historically, this is only the beginning.

Between this year and next year, people will lose faith in the U.S. dollar, and as a result, all paper assets will become toxic; they will be devaluing. So people need to understand if you’re not holding gold and silver and cryptocurrencies they are going to lose out. This year is going to be good, and next year we will see fireworks for gold, silver, and crypto.

Article originally published on https://bopolny.com/Articles from Bo Polny

View blog

Bo Polny Interview · Greg Hunter on USA Watchdog · October 2, 2020 · Previously, I predicted that so ...

Based on STAGE is set for HUGE MOVES Cryptos, Gold & Silver!!! · Interview with Bitcoin Ben · Jun 19 ...

Based on ALL World Currencies BURN!!! · Bo Polny Interview · Wild West Crypto Show · Aug 14, 2020 · ...

You may be interested in these jobs

-

Shipping and Receiving Clerk I

Found in: Lensa US P 2 C2 - 6 days ago

FedEx SupplyChain Lebanon, United StatesNear I-65 & IN 267 in Lebanon Indiana First Shift Monday 0 Thursday 6:00 a-4:30 p $21.50 per hour About FedEx Supply Chain FedEx Supply Chain, a subsidiary of FedEx Corp. (NYSE: FDX), is a leader in the third-party logistics industry offering a diver Receiving Clerk, Shipping, Re ...

-

Physician / Urology / Wisconsin / Locum or Permanent / Urology Physician Job near Fond du Lac, Wisconsin Job

Found in: One Red Cent US C2 - 41 minutes ago

Hayman Daugherty Associates, Inc Fond Du Lac, United StatesA well established Hospital in Eastern Wisconsin is seeking a dynamic Board Certified/Board Eligible Urology physician. It is expected the person accepting this position would obtain and/or maintain board certification throughout employment. The Urology practice is comprised of t ...

-

Relief Veterinarian

Found in: Lensa US P 2 C2 - 4 days ago

VCA Animal Hospitals Edgewater, United StatesWe are seeking an experienced Relief Veterinarian to join our team. · In this position you'll use your superior medical judgment combined with a high level of empathy, confidence and humility to build a loyal client base and heal pets. · As a member of the VCA family, your pass ...

Comments