An Update on the Markets | Bob Klein of Medici Capital

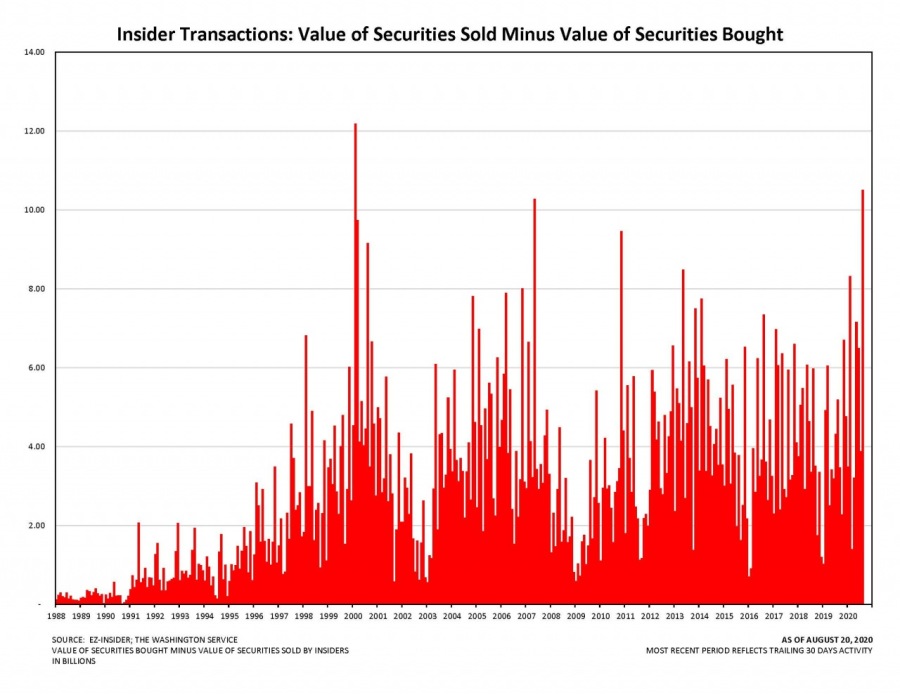

The stock market is stumbling higher struggling with heavy new supply of stock from stock sales by insiders and from new stock offerings by companies. Executives are rushing to sell to take advantage of the very elevated valuations. Sales of stock by insiders has never been higher, except for the period just before the dotcom/tech bubble burst.

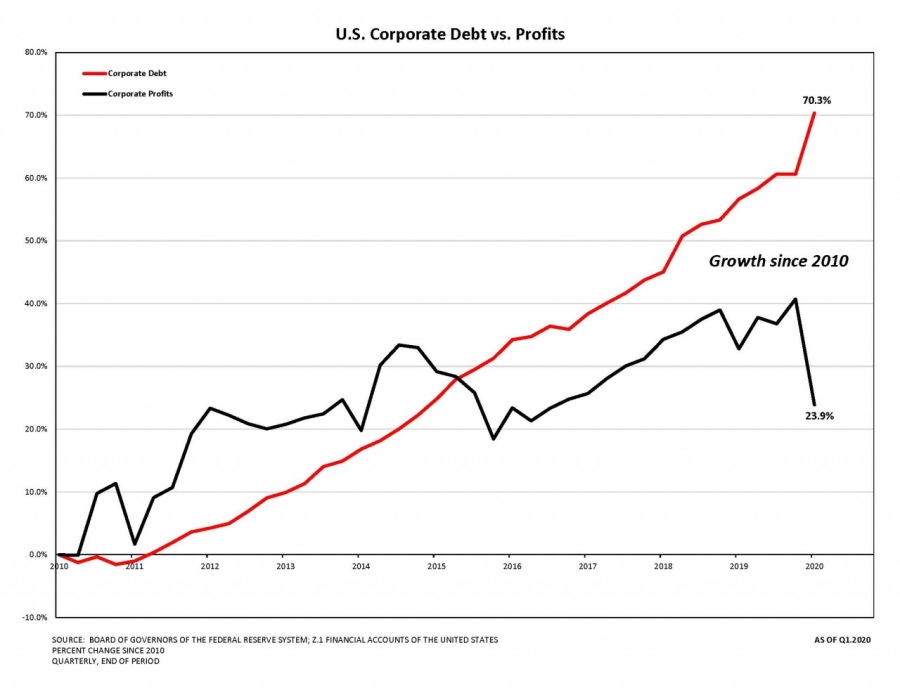

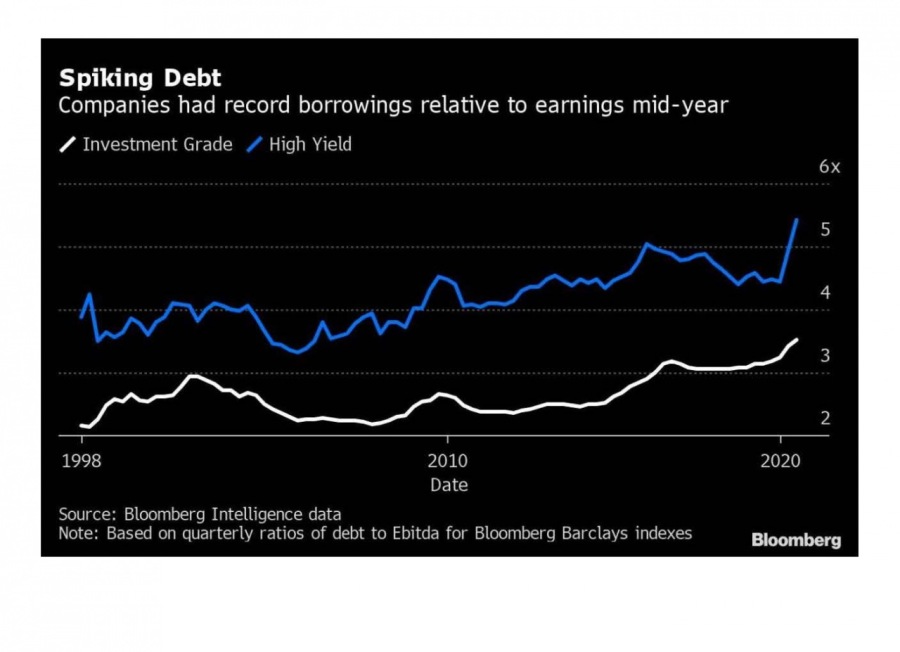

In time, as scientists win the battle against the virus, the pandemic will go away, but the debt incurred during the crisis will not. Businesses and the U.S. government are borrowing record sums in response to the virus. The interest on this debt will need to be paid, thus increasing the overall burden on the economy. Corporate debt is at a new record high relative to a widely-used cash flow measure.

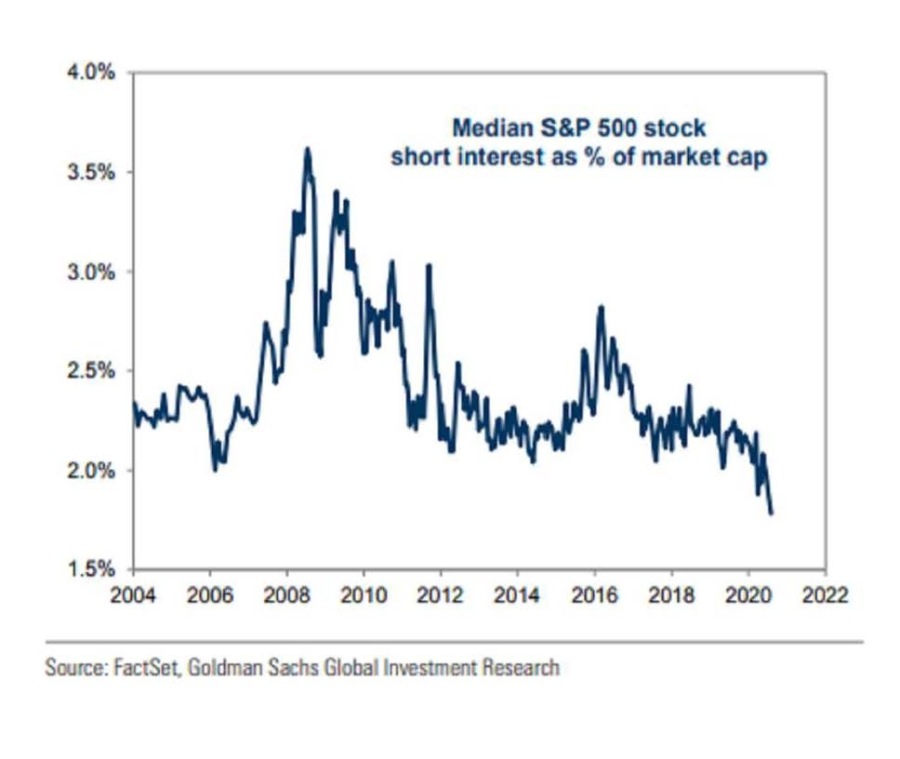

The amount of shares sold short in the overall stock market is at a 15-year low. A significant source of demand for stocks is the demand by short sellers to buy back the stock that they have previously sold short. Since there are relatively few shares sold short, this traditional source of demand to buy stocks will be far less of a factor in pushing the market higher.

Share buybacks by companies are also way down since companies are too heavily indebted and uncertain about the economic outlook to be buying back their own stock. Share buybacks have been the most impactful source of demand for stocks since the market bottom in 2009. Finally, insider buying at these high prices is practically nonexistent. As I discussed above, insiders are doing far more selling than buying.

The only stimulus for the demand for stocks remains the Federal Reserve. They have jammed rates on short-term cash to zero, and thus investors are buying stocks because they have no easy alternative. Nevertheless, the amount of the cash available to buy stocks is low relative to the stretched valuations of companies in the market. The stock market appears to be running on fumes, now. The upward momentum has slowed, and for the most part, the tech sector represents the only industry group that is rising significantly, as investors are all piling into the same names. Hardly signs of a strong and healthy market.

Meanwhile the market is facing weakening earnings and a very negative political climate. Both parties are pushing for more government spending, which leads to higher taxes, either explicitly or implicitly, as the government resorts to printing money to pay for the spending. In the latter case of printing money, the tax is borne by all us in the form of rising prices on the things we buy on Main Street. Also, both parties are moving toward price controls on pharmaceutical drugs. The controls coming to the healthcare industry do not bode well for the quality of care, nor are they positive for future profits for the drug companies, medical equipment makers, hospitals, or doctors. The burdens on the private sector continue to mount.

I have never been so optimistic about the immense opportunities on the short side of the market. The crowd is bullish, yet very rich valuations relative to prospective earnings are signaling grave danger ahead for stocks. I continue to believe the next major move in the stock market will be down.

This blog is for informational purposes only and does not constitute an offer to sell, nor a solicitation to buy any security.

Articles from Bob Klein

View blog

Stretching back over thousands of years, China has had plenty of time to refine their currency syste ...

Nearly 2,700 years ago in the old city of Efsos, a wealthy merchant and trading town located in Hell ...

Curtis Pride’s story is both emotional and inspirational. From 1993 to 2006, Pride served as an outf ...

You may be interested in these jobs

-

Chief Technology Officer

Found in: Appcast US C2 - 5 hours ago

Genius Talent Boston, United StatesThis is an exciting and challenging opportunity for a highly motivated Chief Technology Officer. Joining the team at the start of a pivotal journey, you will drive change, improvement, and measurable success across the technology, digital and data projects. · You will play a cruc ...

-

Delivery Driver

Found in: One Red Cent US C2 - 5 days ago

AutoZone Farmville, United States Part timeAutoZone S MAIN ST [Non-CDL / Route Driver] As a Delivery Driver at AutoZone, you'll: Drive delivery vehicle to transport parts to commercial customers; Load and unload parts; Pick up returns, cores and parts from nearby stores or outside vendors; Maintain a safe driving and work ...

-

Speech Pathologist-SPRN 2-PCR

Found in: Lensa US P 2 C2 - 1 day ago

Piedmont HealthCare St Albans, United StatesJOB PURPOSE: · Provides speech-language pathology services by coordinating consultations and diagnostic evaluations with patients having known or suspected communication disorders and/or oropharyngeal dysphagia; and interpreting assessment data; planning and performing speech-lan ...

Comments