Net Profit vs Cash Flow

![From Small-Business Primer by Phil Friedman

Net Profit vs Cash Flow

Phil Friedman

MARINE INDUSTRY & SMALL-BUSINESS CONSULTANT

Fort Lauderdale, FL, USA

Tel: 1.954.224.2145

Email: phil@portroyalgroup.com

FULL RANGE OF PROJECT, OPERATIONS, AND

MARKETING MANAGEMENT SERVICES

www.PortRoyalGroup.com - www.YachtbuildAdvisor.com

CLICK HERE FOR MORE INFO]](https://contents.bebee.com/users/id/10277593/article/net-profit-vs-cash-flow/2207d6bc.jpg)

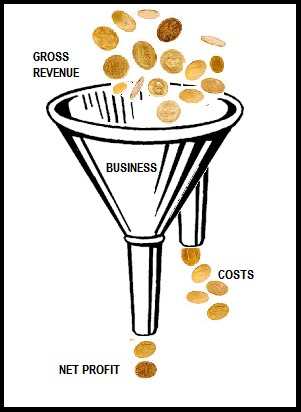

UNDERSTANDING THE DIFFERENCE BETWEEN PROFIT AND CASH-FLOW IS ESSENTIAL TO THE SUCCESSFUL OPERATION OF A SMALL BUSINESS...

Preface: This post is not intended as an instructional manual for accountants or bookkeepers, but rather as a conceptual guide for small-business operators and would-be small-business owners who may not be adequately familiar with these critical core business concepts.

Profit is a financial benefit that is realized when the ... revenue gained from a business activity exceeds the expenses ... needed to sustain the activity.

Investopedia

Profit is what's left over from Revenue after you've paid all of your costs in doing business. But profit is not the same thing as cash since profit can accumulate in a number of different forms.

For example, if you buy a piece of property at, say, $100,000, and in the first year, its reliable market value goes up to an average $120,000, you've made (at least, on paper) a $20,000 profit.

However, if you check your pockets or your register drawer, you will not find an extra twenty grand laying around there. In other words, you've made a profit, but you haven't generated any cash. And you won't until you sell the property or borrow against the increase in the property's market value.

Similar circumstances can come up in business. You may be making a healthy net profit on your gross sales revenue, but that profit might be tied up in accounts receivable ― payments owing to you from clients or customers for goods or services you've already delivered. Or you can have profit tied up in inventory you've already paid for but haven't yet sold or in equipment you've paid for but which has many years of useful life remaining. Such items represent value and equity in your business and, as such, are repositories of profit. But unfortunately, they are not cash.

The problem is you need cash to pay any employees who may work for you. You need cash to pay for rent, utilities, and other current recurring expenses. And you can need cash in order to purchase goods for eventual delivery to your clients and customers.

Which is why more than a few small businesses have been forced to close for lack of available cash, even when they were solidly profitable.

There are several potential sources of incoming cash in a business: sales revenues, investment dollars, loan proceeds, and retained net profits. If the current total inflow of cash is sufficient to cover your current necessary outflow (expenses), then you can stay in business. But that doesn't mean your business is profitable.

Even when you have enough cash to pay your bills every month, you may still be operating at a net loss. Here's why.

If you're using a current inflow of investment dollars to pay your current operating expenses, you're taking in investment, but not building equity or value in the business. And if everything remains the same, when the investment inflow dries up, at some point you will no longer be able to keep the doors open or the lights on.

It's the same if you're using loan proceeds to pay for current operating expenses, except worse because using loan proceeds to stay open simultaneously builds debt that has to be serviced with ― you guessed it, cash.

Robbing Peter to pay Paul cannot go on forever (except perhaps in the case of Amazon) because eventually the growing debt requires more cash to service than you have available ... and you will go out of business.

There is a tendency these days to concentrate on cash flow while not being much concerned with profit. This attitude is a carry-over from the practices of large companies that attract truckloads of investor cash as a result of selling shares in the company.

Sometimes such companies can survive for years, even decades on the cash flow thus generated, while at the "back end" racking up negative profits (losses) each year. Investors in such companies don't really care because they are more interested in trading the stock of the company in an effort to generate their own profits, as opposed to sharing in the net proceeds thrown off by owning a share of a profitable company.

Focusing on cash flow alone may work for companies like Amazon ― which historically operated at a fiscal loss for almost two decades. But it rarely, if ever works for small businesses, which almost always have to generate profit in order to remain viable.

Plain and simple, profit is what's left over from sales revenues, after you've paid all of the costs involved in producing those revenues. In a perfect ― and simple ― world, that profit would be in the form of cash that could be re-flowed back into the business in the service of building value and equity.

Unfortunately, more often than not, a portion of the profit shown on paper exists in the form of non-cash assets of the business. Which is why it's essential for a small-business person to understand the difference between profit and cash flow, and continually keep an eye on both.

― Phil Friedman

Postscript: One of the key financial skills needed by a small-business person is the ability to manage cash flow and, as needed, convert non-cash repositories of retained profits into operating cash. We'll deal with some tips for accomplishing this in a future installment of this series. ― PLF

Author's Notes: If you found this article worthwhile, you might want to takes a look at the following posts:

"Common Myths About Starting Your Own Small-Business"

"Avoid Marketing Myths That Bite"

"Avoid the Pitfall of Excessive Positivity"

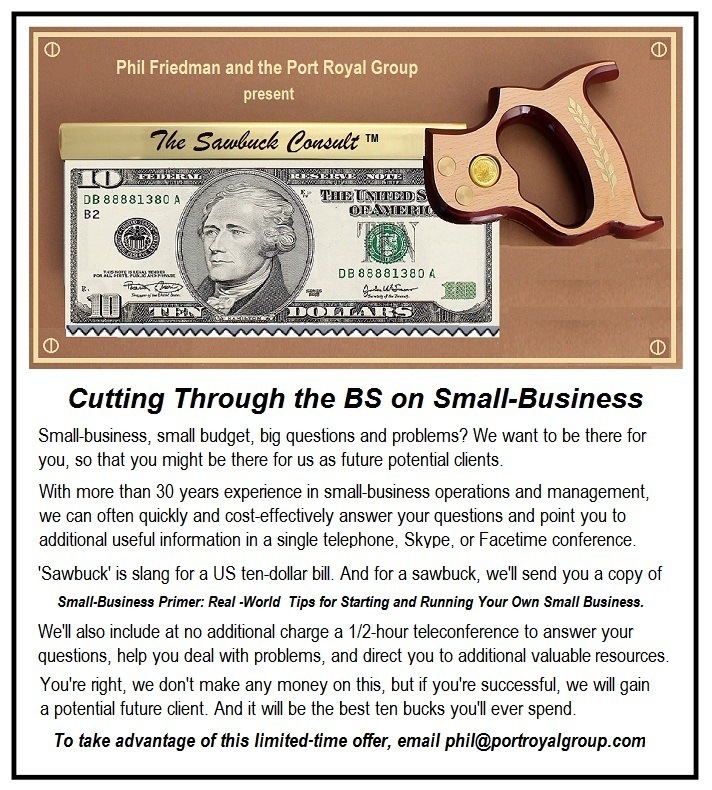

You might also be interested in my new eBook, Small-Business Primer: Real -World Tips for Starting and Running Your Own Small Business.

For information on securing a copy, email phil@portroyalgroup.com and put "small-business book" on the subject line.

Are you starting up or currently operating a small business and facing a problem or issue on which you could use some help? Consider our offer below:

About me, Phil Friedman: With 30 some years background in small business and the marine industry, I've worn numerous hats — as a yacht designer, boat builder, marine operations and business manager, marine industry consultant, marine marketing and communications specialist, yachting magazine writer and editor, yacht surveyor, and marine industry educator. I am also trained and experienced in interest-based negotiation and mediation. In a previous life, I taught logic and philosophy at university.

#SMALLBUSINESS #BUSINESSMANAGEMENT #BOOSTPROFIT #BETTERBUSINESS #BUSINESSCONSULTING #ENTREPRENEURSHIP #STARTYOUROWNBUSINESS #ENTREPRENEUR #BUSINESSSTARTUP #RUNNINGYOUROWNBUSINESS #CASHFLOW #PROFIT #P&L #CASHMANAGEMENT #PROFITVERSUSCASHFLOW

Articles from Phil Friedman

View blog

HEADED TO THE YARD FOR A REFIT? AVOID THE SHOALS OF UNANTICIPATED COSTS ... · Avert grounding on the ...

SEATTLE YACHTS' RE-INTRODUCTION OF THE LEGENDARY ALASKAN LINE OF TRAWLER-STYLE YACHTS CONTINUES TO A ...

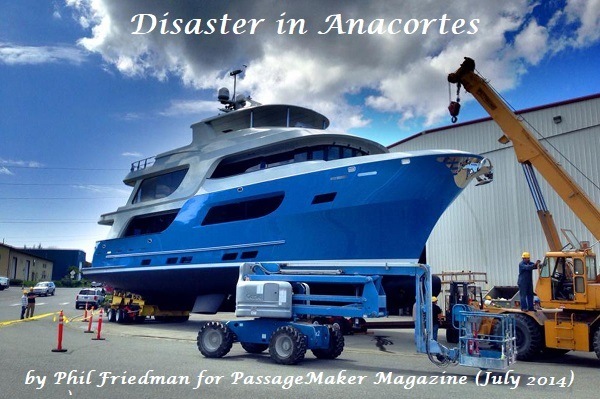

LOOKING BACK AT THIS PIECE I WROTE FOR PASSAGEMAKER MAGAZINE IN 2014, IT SEEMS THAT THE DARK CLOUD S ...

Related professionals

You may be interested in these jobs

-

Shift Manager

Found in: beBee S2 US - 3 weeks ago

Sonic Drive-In London, United States Full timeDescription: · Employer: Old Blue, LLC · POSITION: SHIFT Manager · IMMEDIATE SUPERVISOR: GENERAL MANAGER, ASSISTANT Manager · STATUS: HOURLY NON-EXEMPT, Hired in as full time employee · There are two kinds of people in this world: SONIC employees and those who wish they were SONI ...

-

Travel MRI Technologist

Found in: beBee S2 US - 4 weeks ago

FlexCare Imaging Westfield, United States FreelanceFlexCare Imaging is seeking a travel MRI Technologist for a travel job in Westfield, Massachusetts. · Job Description & RequirementsSpecialty: MRI Technologist · Discipline: Allied Health Professional · Start Date: 04/02/2024 · Duration: 13 weeks · 40 hours per week · Shift: 8 ho ...

-

Assistant Teaching Professor, Trumpet

Found in: beBee S2 US - 4 days ago

Florida International University Miami, United States Full timeAssistant Teaching Professor, Trumpet · Job Opening ID531148 · LocationModesto A. Maidique Campus · Full/Part TimeFull-Time · Regular/TemporaryTemporary · Job ID531148 · Location · Modesto A. Maidique Campus · Full/Part TimeFull-Time · Regular/TemporaryTemporary · About FIU · Flo ...

Comments

Phil Friedman

5 years ago #54

You'll also find, Aaron \ud83d\udc1d Skogen, that firms which operate indefinitely on "positive cash flow" whilst racking up losses on their operating statement, are usually firms that are drawing in serious amounts of investor capital on a continuous basis. And that it's the inflow of capital investment that keeps them alive. What's usually overlooked in such situations is the fact that investor capital is actually a liability on the balance sheet because it has eventually to be paid back in one form or another. Unless the investors are content with receiving just their worthless stock certificates as in investing in "unicorn" companies. Cheers!

Neil Smith

5 years ago #53

Phil Friedman

6 years ago #52

Yea, Renee, well those who converse with my favorite Mad Scientist, Gerald Hecht, often need more than just one drink afterward. :-)

Phil Friedman

6 years ago #51

Okay, well then allow me to advise my Canadian-based business Bees that I have consulting associates available with Canadian grant writing and Canadian government program management experience. We can help you search for and apply to appropriate agencies for small business grants. Connect with me on beBee or LinkedIn or contact me directly by email or Skype. Cheers!

Phil Friedman

6 years ago #50

In this insane age of Trumpentia (rhymes with dementia), I wonder that myself. I am not talking about filling out forms. Any half-witted typist can do that. I'm talking about someone who can draft compelling plans and narratives, the kind that catch the fancy of grant committees. That is what small business people need. For the record, I was myself the recipient of a three-year Canada Council Doctoral Research Grant, a Canada Government Employment Stimulation Grant for the development of a computerized boatbuilding specification software system, and a key player in securing for Humber College Ontario grant monies for the creation of a post secondary program in marine industry operations and business management. So I do know what you're talking about. Thanks for the link. Have you thought about helping small businesses in the area of Grant writing?

Phil Friedman

6 years ago #49

Please do, Renee. Have you ever written proposals for firms? Grant writing is a profession when it comes to non-profits, but I don't know if there are grant writers for businesses.

Phil Friedman

6 years ago #48

That makes sense, Renee, although last time I visited Tarranna, the underground cash and barter economy still seemed to be alive and well. :-)

Phil Friedman

6 years ago #47

Phil Friedman

6 years ago #46

Phil Friedman

6 years ago #45

Thank you, Preston, for reading and commenting. You are correct and I guess the core point that I'm trying to make here is that running a business at a consistent loss, while relying on cash flow alone to stay afloat, is effectively a ponzi game. In such a case, the objective has to be to exit the business BEFORE it falls into bankruptcy, preferably by selling it to someone else based not on a multiple of annual net profit, but on some cockamamie calculation of potential future profit due to established market share and potential for additional sales of company stock to new investors. In other words, something like the $26 billion sale of LinkedIn to Microsoft.

Phil Friedman

6 years ago #44

Yes, Gerald Hecht, to an extent, one might look on beBee to the "Profits of Broom."

Milos Djukic

6 years ago #43

John, my ignorance is also a strong source of tolerance :)

Milos Djukic

6 years ago #42

My best to you too Phi, my friend.

Phil Friedman

6 years ago #41

No, John, it is not a "petty squabble." And I find it highly offensive that you should refer to it in that way, given the facts of the situation. In the first place, it is not a conflict which I started, or even responded to -- until the attacks crossed the line into libel and defamation with clear intention to damage my professional reputation. I doubt, John, that you would be sanguine about my coming onto your posts to say that you faked your professional qualifications or that there was no substantiation for any of the professional experience you laid claim to. Never mind that it was all well documented and accompanied by letters of recommendation from real and prominent industry professionals. In the second place,on beBee, for the most part, I ignored the attacks until I had it "up to here" and responded. At which point I was criticized by some for, as Kevin Pashuk has put it, for returning a punch in the nose after being myself punched several times by a schoolyard bully. I never went onto any post by RB to criticize or engage, yet was stalked and repeatedly attacked on my posts through misrepresentation and vague innuendo. (continued pt II)

Phil Friedman

6 years ago #40

John - Pt II. Thirdly, several exchanges became sufficiently heated that I agreed with Javier never to comment on RB's posts and he asked RB never to comment on mine, to which request RB agreed. But since it appears to be a matter of compulsion, RB violated that agreement and was booted off the platform. When several people wrote to me to say I must be glad it finally happened, I replied I hoped it was for the right reasons, not simply because he disagreed with various people. Then RB changed his profile name and reappeared on beBee, and was allowed to stay, was told, on the condition that he did not repeat his prior behavior. But again, he could not control himself and came onto a very serious business-related post of mine to repeat his scurrilous attacks and comments. And so was again removed from the platform. If you cannot see the difference, well, that says something too, I guess. Probably that your reaction is colored by your own personal experience when you voiced some criticisms of beBee. I wish you well.

Phil Friedman

6 years ago #39

Milos, I think I did not explain my comment to you sufficiently. In no way did I intend to say that you are disruptive or inconsiderate. What I was saying was that, if anything, I think you sometimes take tolerance too far -- in the sense that you are prepared to tolerate things that I will not. I always welcome your comments, even if off topic, because they are always well meaning and sensible. And if you or I or anyone strays occasionally into irrelevance with a quip or a poem or some item of Friday evening silliness, well, that is okay too. What is not okay, in my view, is to bring seriously disruptive issues into the comments of a business or scientific or other serious, non-general post because that is to show disrespect for the author who is striving to deal with a particular topic. It would be like my posting political comments about Donald Trump in a thread attached to a post on the origins of fractals. I agree with you that there has to be a high level of tolerance, but also believe that tolerance should be met with the courtesy of avoiding disruption. My best to you, my friend. Cheers!

Milos Djukic

6 years ago #38

Milos Djukic

6 years ago #37

Devesh 🐝 Bhatt

6 years ago #36

Your message isn't lost in my case. I just did not dedicate myself to fully understanding your links. The Law Studies, my final exams get over on July 20th, perhaps we interacted in a confrontational way earlier. I have developed a bias for Bebee as i could market the tag here to get work but the truth is , everyone whom i got to join bebee finds it a good source for reading, nothing more. They appreciate the activity and interactions the very first day which gives a good feeling, making it worse when they start realising the flaws. We all have different scales of morality, characterisation, tolerance and people traits.. good for a conversation but ultimately these are user traits. What about unique app features thatcan cater to the needs of all? I have identified certain quantifiable needs that can translate into features. Perhaps if bebee could have a quantifiable reward for features incorporated into the app and sourced from users? Just a thought.

Milos Djukic

6 years ago #35

Phil Friedman, I apologize for my interference, disruption and irrelevance. I will avoid this practice in the future. It is a measure of tolerance. Just to note that I did not start anything disruptive. Check my first comment #21 (relevant to the post topic). Then #22 (also relevant to the post topic). Please check then comments by others: #43 - #48, #51 - #53, #56 and #57 (total 11 comments not related to the topic) and the only one comment from me not related to the topic (#54). That's why I'm talking about tolerance.

Phil Friedman

6 years ago #34

That may be true, Milos. And indeed I have myself argued we need to exercise as much tolerance as possible. See: https://www.bebee.com/producer/@friedman-phil/finding-the-right-balance However, I believe it is important to recognize that not every post is a common open forum for discussing whatever one might have in mind. And that we all need to exercise a degree of social media respect by not bringing issue onto a post that are completely irrelevant to its topic. For to do so, is simply to disrupt, rather than foster rational engagement. Cheers!

Milos Djukic

6 years ago #33

Phil Friedman

6 years ago #32

John, it is your prerogative to make whatever personal judgments you wish. I did not say that you were obligated to do any research. What I said is that you are speaking from ignorance of the situation. You say, " You may wish to document the facts as you see them in an open forum." Well, I have in fact done that many times. I will now include several links to my statements I've made related to this particular controversy. You are welcome to read them or not, as you see fit. https://www.bebee.com/producer/@friedman-phil/for-immediate-release-innovative-approach-to-world-cruising-unveiled https://www.bebee.com/producer/@friedman-phil/i-ll-show-you-mine-then-you-show-me-yours https://www.bebee.com/producer/@friedman-phil/finding-the-right-balance https://www.bebee.com/producer/@jim-able/beware-of-imposters-there-is-only-one-real-jim-able https://www.bebee.com/producer/@jim-able/floats-like-a-butterfly-and-when-it-counts-stings-like-a-bee By Jim Murray: https://www.bebee.com/producer/@jim-murray/a-story-about-my-friend-phil-friedman I believe it is fair to say that I have defended you in cases where your comments were being misrepresented and attacked, as evidence by at least one of the above references. I would very much appreciate it if, in return, you would not bring this controversy onto my business-related posts and, in particular, not use the opportunity on my posts to publicize the activities of a venomous troll such as RB. Thank you for affording me that consideration.

Phil Friedman

6 years ago #31

John, I feel no need to justify my position re RB. You would understand if you took the time to look at the facts of the situation going back nearly five years. On LinkedIn, I ultimately had to protect myself by exercising the block function -- the only time I've ever employed it. On Facebook, I have the facility to remain unfriended and disconnected. On beBee, RB has now been ejected from the platform a second time. Any rational person who has knowledge of the history would agree I'd be crazy to join a new platform where he was present, without first ascertaining I'd have the ability to block him and his stalking behavior. My best to you. And cheers!

Javier Cámara-Rica 🐝🇪🇸

6 years ago #30

thanks Phil Friedman for your comment. It is as it is :). Enjoy the weekend!

Milos Djukic

6 years ago #29

Thanks John Vaughan. Regards, Milos

Phil Friedman

6 years ago #28

John, I agree with you that proactive messaging about an author's posts on beBee is not up to par, and I for one look forward to seeing it strengthened in the next iteration of the platform design. In the meantime, I think it important to note that Javier \ud83d\udc1d beBee are committed to distributing 100% of an author's posts to 100% of his or her followers 100% of the time. Moreover, that you can receive an email notice of a new post by a given author by electing on the author's Producer Profile page to follow his or her "blog" by email. Please excuse me if I don't take you up on your invitation to join Alignable.com, since you at the same time extend an invitation to Rob Bacal to do so as well. To paraphrase a well known statement by Groucho Marx, I would not want to be a member of any social media platform that had Robert Bacal as an unblocked member. Robert Bacal (aka Rob Bacal, a name he used when he returned to beBee after being booted off the platform the first time) has for literally years stalked and trolled my posts, first on LinkedIn, then on beBee, with scurrilous attacks on my credibility that employed primarily misrepresentation and vague innuendo. And he has, in fact, libeled and defame me numerous times through the creation of fake profiles and posts reputedly by me and by posting on Pinterest about me some of the nastiest, sick garbage you could imagine. I've stated in print many times that I respect your work and your opinions. But I gotta tell you, you need to be more careful of the company you keep. Cheers!

Phil Friedman

6 years ago #27

Actually, MIchele, I do. I don't know if I'd call them great, but they are interesting -- and instructive. What's great is your idea to share the stories, which I think I'll do in future. Thanks for commenting o and sharing this post. Cheers!

Milos Djukic

6 years ago #26

Milos Djukic

6 years ago #25

#36 #37 #38 :)

Phil Friedman

6 years ago #24

"In any event, none of that changes your suggestions for small business. "We" have to eat". Amazon has many more sources of money to pay their bills! " (RB) Very true. Anyone looking at the situation should understand that by reinvesting profits in capital expansion and other forward-looking expenses before those profits reach the "bottom line" is also a way of shielding them from income taxation. Moreover, that the game at Amazon is a very complicated one. And that the small-business person does not generally have available virtually inexhaustible outside (of the business proper) sources of cash inflow to make up operating losses. Thanks for reading and commenting.

Phil Friedman

6 years ago #23

To quote from the article, which confirms two decades of "no-profit" operation, "When you buy Amazon stock (the main currency with which Amazon employees are paid, incidentally), you are buying a bet that he can convert a huge portion of all commerce to flow through the Amazon machine." The piece confirms that Bezo's game plan is NOT to build returns for investors, but to continually expand it hold on a future share of the market of everything (MoE). What has sustained Amazon in all of this is it flogging of stock to investors and employees. Perhaps Amazon will continue to do well now that it is settling back a bit into a more traditional business model... and maybe not. But I would make the point that the Amazon model of being solely cash-flow driven is not one to be adopted by the average small business.

Phil Friedman

6 years ago #22

Praveen, people continue to trade in the stock in the hope of profiting on the trading. It's effectively a ponzu scam that eventually may very well leave the last shareholders "holding the bag." But whether that is sooner or later, the activity of churning stock is not at all the same as running a business in pursuit of profit. Cheers!

Phil Friedman

6 years ago #21

Phil Friedman

6 years ago #20

Thank you, Praveen, for reading and commenting. I submit that there is very little of what we would normally call "net worth" in Amazon. What they push is their dominance in market share and their potential, all of which has been built not on retained profits, but on the massive inflow of investment. For nearly two decades, Amazon lived on cash flow from selling stock while showing a net annual loss. The question in my mind is what would happen if cash inflow from new investment dried up? Or do you think Amazon is now "too big to fail"?

Phil Friedman

6 years ago #19

The practice in big business these days is often to churn sales as fast as you can, even at a loss -- as long as you're throwing off sufficient cash to keep the lights on. Then sell out based on market share and move on, leaving the certain wreckage in your rear view mirror. But the strategy rarely works for a small-business operator. Cheers!

Milos Djukic

6 years ago #18

Milos Djukic

6 years ago #17

Phil Friedman

6 years ago #16

Thank you, Franci, for the positive words. In my experience, far too man small-business people and would-be small-business operators lack fundamental understanding of P&L, so caught up are they in the idea of owning their own business and with whatever brilliant ideas they are trying to sell. This series is intended to capture and relay the fundamentals in a quick and easy way to understand. Cheers!

Phil Friedman

6 years ago #15

I agree, Matt, that cash flow rules -- in the short term. But if short-term positive cash flow is being generated by incurring long-term debt or by pricing current sales at a loss (thereby building up short to medium term losses), your cash-flow driven actions will eventually kill your business, most likely sooner rather than later. Excepting always, of course, Amazon. Cheers!

Phil Friedman

6 years ago #14

Well, yes, Michael. The happy small-business owner is one who's turned a profit. My concern, though, is that too many think that because they happen to have enough cash on hand to pay the bills, they are actually turning a profit. Which may or may not be true. Cheers!

Phil Friedman

6 years ago #13

Good question, Todd. Only Javier \ud83d\udc1d beBee can say for sure. But my guess is that beBee ownership is relying on its own investment and that of others to keep sufficient cash flowing in, until they've built the MAUs (monthly average user numbers) sufficiently high enough to monetize by either selling commercial access to the accumulated database or sell the platform to some cash-rich corporate mark which is trying to divest itself of the kind of cash reserves that make it a target for a hostile takeover or both. IMHO. Cheers!

Matt Sweetwood

6 years ago #12

Phil Friedman

6 years ago #11

Thanks, Timothy, for reading and commenting. I agree that most small businesses need to be especially careful about collecting on a current basis and not allow too much to accumulate in accounts receivable, nor in pre-paid expenses, paid-up equipment investments, or other capital expenditures. For although all of the latter are carried on the Balance Sheet as assets and so are what I call "repositories of retained profit", they are not cash and so can actually contribute to a critical shortage of needed cash. Personally, I am not sure that studying accounting helps many small-business people because it is often heavily weighted on the mechanics of bookkeeping and light on understanding the meaning of the P&L and the Balance Sheet. And I believe that one can grasp the underlying concepts without knowing much about, for example, the procedures of double-entry accounting. Cheers!

Phil Friedman

6 years ago #10

Yes, Wayne, I feel your pain, having had similar experience as a teen and young adult. Far too many small-business people lack a decent grasp of even the most fundamental fiscal management principles -- which is a big part of my motivation in writing and publishing this particular series and it offering The Sawbuck Consult. Thanks for reading and commenting, bud. Cheers!

Wayne Yoshida

6 years ago #9

Phil Friedman

6 years ago #8

Phil Friedman

6 years ago #7

Thanks for reading and commenting, Jerry. You are absolutely correct. We may be talking bedrock fundamentals here, but the fact is that too few small-business and would-be small-business people adequately grasp them. Cheers!

Graham🐝 Edwards

6 years ago #6

Jerry Fletcher

6 years ago #5

Phil Friedman

6 years ago #4

Thanks, Bill, for the kind words. Cheers!

Phil Friedman

6 years ago #3

Pascal, some pundits are fond of telling us that most small businesses fail for lack of sufficient initial capital. That may not I think be exactly true because some few survive to prosper despite that lack. I tend to think the real reason is not having a clue about the fundamental elements of business management. Thanks for reading and commenting. Cheers!

Bill Stankiewicz

6 years ago #2

Pascal Derrien

6 years ago #1