The GOP Tax Plan Explained To Simpletons

The editorial staff of The Lint Screen is not schooled in complex subjects like economics, so we approached Paul Ryan, Speaker of the House of Representatives, for an explanation of the new GOP Tax Plan.

“It’s quite simple,” Speaker Ryan said. “Our tax plan lessens the tax burden on corporations and the one percent most wealthy Americans. These are the job creators of our economy. With the extra money the companies receive in tax savings, they will hire many more people and give higher salaries and bonuses to their current employees. They’ll probably even throw their employees a big party, with sheet cakes, party favors, and premium ice cream! And the extra money that goes into the pockets and off-shore accounts of super wealthy people, well, that becomes fuel for them to build new factories and hire lots and lots of people. So, the net-net is a win-win! We want to give big tax breaks to the people who will use it best, and then that wealth will trickle down to the little people. It’s like a mama bird feeding her baby chicks.”

Speaker Ryan flashed his baby blues and gave his famous Pepsodent smile as he mopped his sweaty brow. “It’s really just simple economics and common sense,” he said

This reporter questioned why it wouldn’t be better to simply give tax breaks to the lower and middle classes. Speaker Ryan laughed.

“I see you don’t understand economics. If we give commoners tax breaks, they’d just stuff the money into their mattresses, and that does absolutely nothing to create jobs. No, you can’t possibly give money to ordinary workers. That would stall the U.S. economy. Peasants don’t know what’s good for them, but we sure do! Our GOP trickle-down approach is a proven way to really turbo boost the American economy. We project a 20% growth in G.D.P., maybe even as much as 530% growth! It’s very exciting.”

The reporter asked why golf course owners receive a tax break and estate taxes will change to significantly benefit the uber-rich, while taxes will go up for many lower and middle-class people. Ryan became enraged.

“Haven’t you been listening, moron? The job creators need money to create jobs for you bumpkins. How can you have a working class if there’s no work? This interview’s over, I’ve got to go vote so we can help job creators create more jobs, and my team can get some campaign contributions. You idiotic journalists don’t understand a damn thing! Goodbye.”

Speaker Ryan left the room, leaving behind the strong scent of Boss cologne and Vitalis Hair Tonic.

##########################################

Patrick Scullin is an empathetic adman and founder of ASO Advertising.

He has two blogs: Empathetic Adman (marketing pontification) and The Lint Screen (satire, smartassery humor, pop culture ramblings, and advice for people getting hip replacements).

Articles from Patrick Scullin

View blog

Rep. Marjorie Taylor Greene to star in upcoming production. · Attendees to last week’s CPAC in Dalla ...

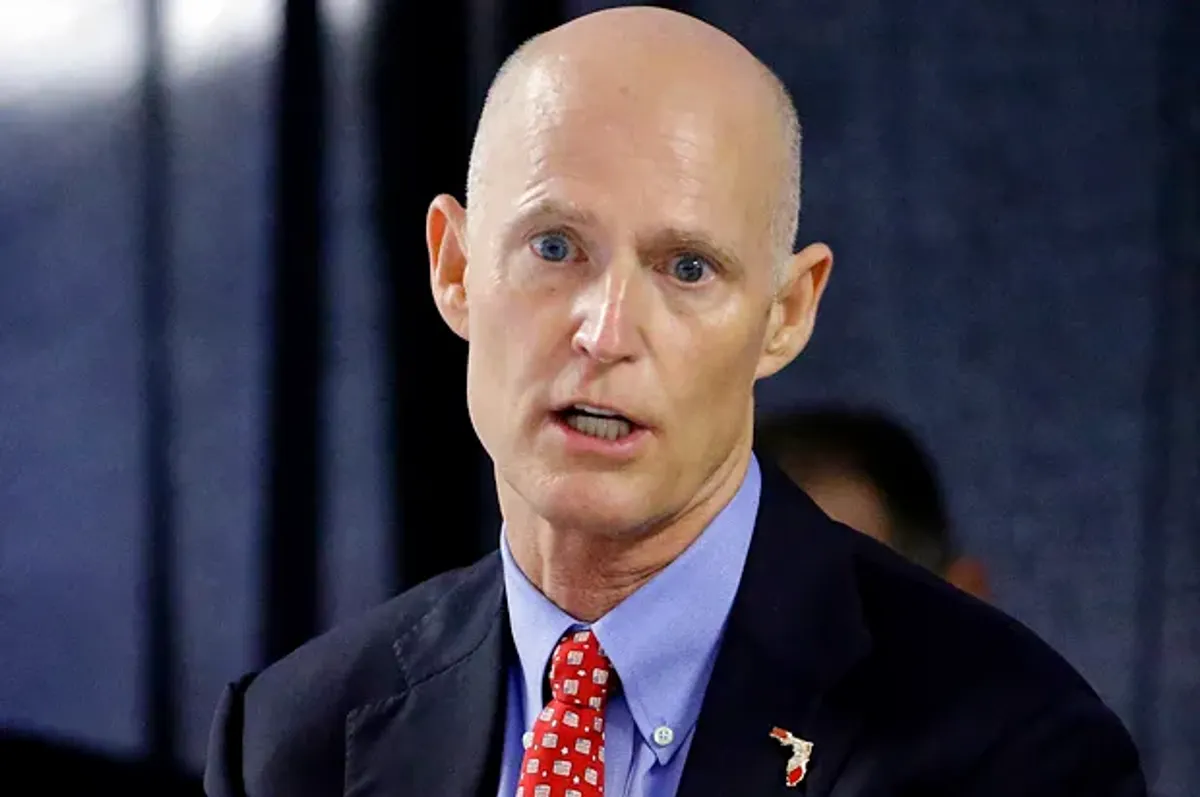

"Hershel is much more Christian than Rev. Warnock," claims Sen. Rick Scott. · Sen. Rick Scott of Flo ...

Ex-prez promises lots of stuff at his rally. · Disgraced twice-impeached ex-President Donald J. Trum ...

Related professionals

You may be interested in these jobs

-

Product Marketing Manager

2 days ago

Sendbird San Mateo, United StatesJob Description · Job DescriptionAs a Product Marketing Manager at Sendbird, you aim to help the company expand its new omnichannel business messaging product line in digital communications. Success is measured by the pipeline generated and the new revenue we can book from these ...

-

massage therapist

1 week ago

PCH Hotels and Resorts Montgomery, AL , USA, United StatesUtilizes therapy techniques for guests'/visitors' overall relaxation. Previous experience required. State issued license required. Certification in massage therapy required. Excellent guest relation skills. ...

-

College of the Albemarle Elizabeth City, United States* Open until filled* · The Student Accounts Receivable Specialist/Cashier is responsible for managing all aspects of collections on accounts receivable, engaging with students to address account concerns, processing payments, and maintaining accurate financial records. The role r ...

Comments

Cyndi wilkins

6 years ago #3

#2 Oh man does the truth hurt...not even KY jelly can ease the pain of that;-)

Phil Friedman

6 years ago #2

Jim Murray

6 years ago #1